₹190 Share Reach All-time High, Strong Results Are Expected; Know The Huge Target

Today, in this post we’ll discuss about Zomato latest news, fundamentals, potential growth areas, and all sorts of information regarding this company to gain a better understanding. We hope our analysis will provide you better insight about the company.

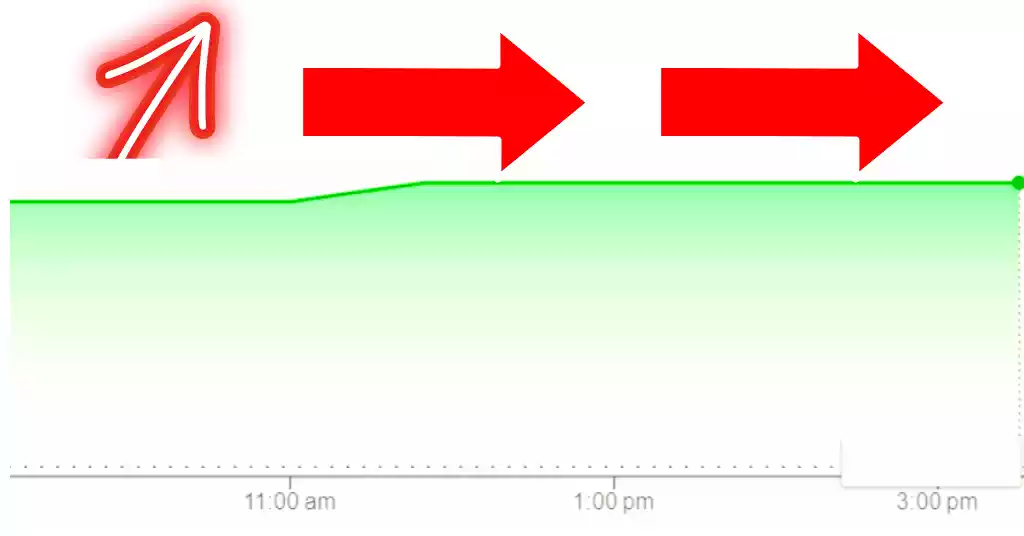

The shares of the online food delivery service Zomato (NSE: ZOMATO) reached an all-time high during the final trading day of this week.

Zomato’s stock hit 192 rupees during the day and was closed at Rs 191 which is a stock rising by two percent.

The Q4 results season will begin in the coming week. Kotak Institutional believes that its performance during the March quarter is going to be impressive.

This stock has provided an annual return of 270 percent within a year.

Expected Q4 Performance To Be Exceptional

Kotak Securities has increased the price target of Zomato shares from Rs 190 to Rs 210. Expectations for strong performance during this quarter’s March quarter.

An annual increase of 25% could be likely for Blinkit’s GMV for food deliveries during the fourth quarter of this year.

The gross merchandise value of Blinkit could also increase by a factor of two. Blinkit will gain a lot from opening new stores.

1st January Zomato announced an increase in the fees for its platform. Its benefits will also be evident in the results for this quarter.

There is a great chance to boost the market share of the company. In light of these aspects, brokerage firm has increased the price target from Rs 190 to Rs 210.

Share Price History Of Zomato

Zomato’s shares have witnessed the value of their shares increasing over an extended period.

The share was trading at Rs 191. The stock has risen by 15 percent in just one month.

It has increased by 43 percent over three months, 55 percent in the first three months of this year, and the 270 percent mark in just one year.

The year 2024 saw this stock was at a value of 121 as of the 18th of January. On January 20, 2023, the amount was the amount of Rs 44.

About Zomato Ltd Company

Zomato Ltd is an online food service platform established in the year 2010. It’s a technology platform that connects restaurants, and delivery partners to meet their diverse requirements.

It provides the ability to search for restaurants and discover them through an app and website, offering comprehensive information about restaurants.

Customers use the app to find, and rate restaurants and establish their foodie network for dependable recommendations.

It’s been extended to include Online Ordering Table Reservations, the Whitelabel Platform, and the Point-of-Sale option.

The company’s authorized capital is ₹1,517.37 crore, and it has ₹871.09 crore paid-up capital.

Fundamental Analysis of Zomato Ltd

| Market Cap | ₹ 1,68,017 Cr. |

| Current Price | ₹ 190 |

| 52-wk High | ₹ 192 |

| 52-wk Low | ₹51.8 |

| Stock P/E | — |

| Book Value | ₹ 22.9 |

| Dividend | 0.00 % |

| ROCE | -5.79 % |

| ROE | -5.91 % |

| Face Value | ₹ 1.00 |

| P/B Value | 8.30 |

| OPM | -2.55 % |

| EPS | ₹ -0.02 |

| Debt | ₹ 521 Cr. |

| Debt to Equity | 0.03 |

Zomato Ltd Share Price Target 2024 To 2030

| Year | 1st Target | 2nd Target |

| 2024 | ₹ 165 | ₹ 200 |

| 2025 | ₹ 210 | ₹ 245 |

| 2026 | ₹ 265 | ₹ 285 |

| 2027 | ₹ 305 | ₹ 315 |

| 2028 | ₹ 326 | ₹ 355 |

| 2029 | ₹ 385 | ₹ 405 |

| 2030 | ₹ 415 | ₹ 454 |

Zomato Ltd Shareholding Pattern

| FII Holding | |

| Dec 2022 | 56.74% |

| Mar 2023 | 54.61% |

| June 2023 | 54.43% |

| Sept 2023 | 54.72% |

| Dec 2023 | 54.88% |

| DII Holding | |

| Dec 2022 | 7.43% |

| Mar 2023 | 8.04% |

| June 2023 | 9.93% |

| Sept 2023 | 13.04% |

| Dec 2023 | 15.47% |

| Public Holding | |

| Dec 2022 | 33.57% |

| Mar 2023 | 35.15% |

| June 2023 | 33.56% |

| Sept 2023 | 30.42% |

| Dec 2023 | 27.98% |

| Others Holding | |

| Dec 2022 | 2.26% |

| Mar 2023 | 2.22% |

| June 2023 | 2.09% |

| Sept 2023 | 1.82% |

| Dec 2023 | 1.66% |

Zomato Ltd Share: Last 5 Years’ Financial Condition

To better understand how the market is performing, let’s look at the outlook of this share in the previous years.

However, investors should be aware of the risks and the market conditions before making any investment decision.

Last 5 Years’ Sales:

| 2019 | ₹ 1,313 Cr |

| 2020 | ₹ 2,605 Cr |

| 2021 | ₹ 1,994 Cr |

| 2022 | ₹ 4,192 Cr |

| 2023 | ₹ 10,608 Cr |

Last 5 Years’ Net Profit:

| 2019 | ₹ -1,010 Cr |

| 2020 | ₹ -2,386 Cr |

| 2021 | ₹ -816 Cr |

| 2022 | ₹ -1,222 Cr |

| 2023 | ₹ -12 Cr |

Last 5 Years’ Debt-To-Equity Ratio:

| 2019 | 0 |

| 2020 | 0 |

| 2021 | 0 |

| 2022 | 0 |

| 2023 | 0 |

Last 10 Years’ Profit Growth:

| 10 Years: | — |

| 5 Years: | — |

| 3 Years: | 16% |

| Current Year: | 99% |

Last 10 years’ Return on Equity (ROE):

| 10 Years: | — |

| 5 Years: | -21% |

| 3 Years: | -9% |

| Last Year: | -6% |

Sales Growth Over 10 Years:

| 10 Years: | — |

| 5 Years: | 72% |

| 3 Years: | 40% |

| Current Year: | 70% |

Conclusion

This article is a complete guide about Zomato Ltd Share.

These information and forecasts are based on our analysis, research, company fundamentals and history, experiences, and various technical analyses.

Also, We have talked in detail about the share’s future prospects and growth potential.

Hopefully, these informations will help you in your further investment.

If you are new to our website and want to get all the latest updates related to the stock market, join us on Telegram Group.

If you have any further queries, please comment below. We will be happy to answer all your questions.

If you like this information, share the article with as many people as possible.

Disclaimer: The information on this site is only for informational and educational purposes and shouldn’t be considered financial advice or stock recommendations. We are here to provide timely updates about the stock market and financial products to help you make better investment choices.