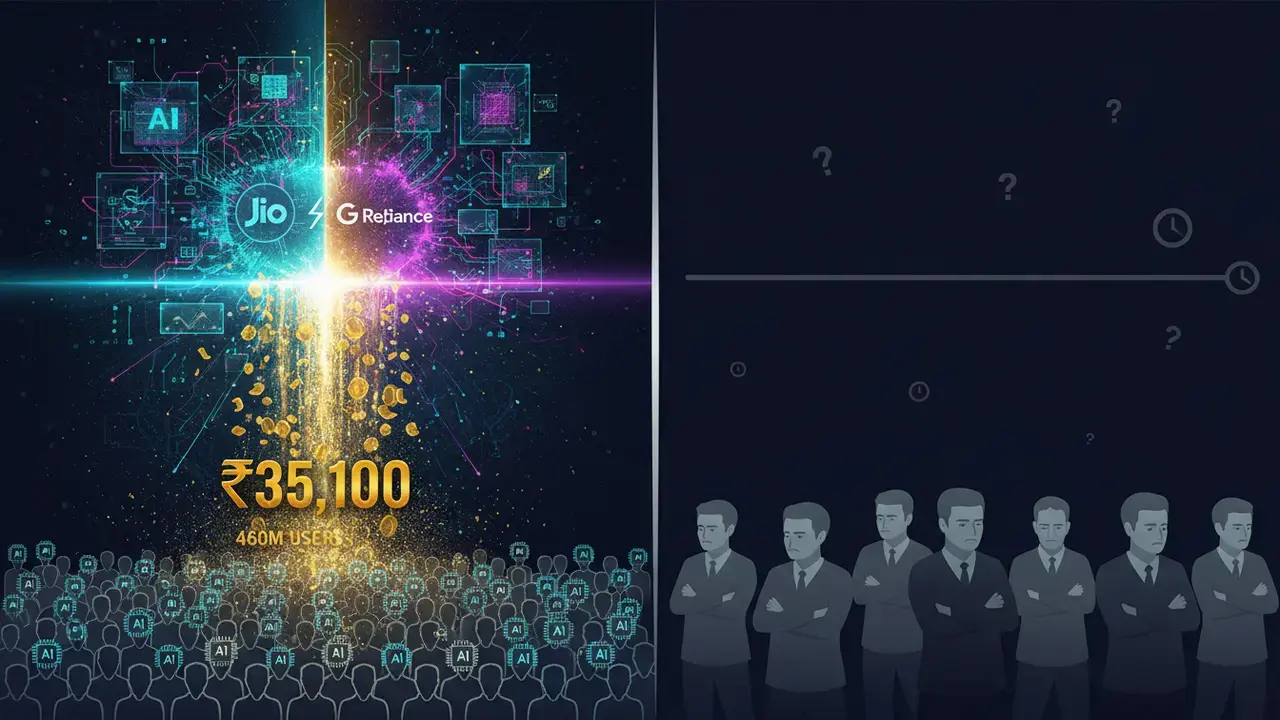

Reliance Bets $15B on AI for 460M Jio Users—But Stock Stays Flat at ₹1,488

Show Table of Contents

Reliance Industries just handed 460 million Jio users free access to Google’s premium AI tools worth ₹35,100 per subscriber—but the stock barely moved, trading flat at ₹1,488 on October 31. For traders, this muted reaction to a massive strategic partnership signals either market fatigue with AI announcements or skepticism about near-term monetization. The real question: Is this a long-term ecosystem play that won’t move the needle for quarters, or is the market missing a fundamental shift in Reliance’s digital monetization strategy?

What Happened: Reliance Bets Big on AI Infrastructure

On October 30, 2025, Reliance Industries—through its AI subsidiary Reliance Intelligence—announced a sweeping partnership with Google to accelerate AI adoption across India. Eligible Jio users aged 18-25 on unlimited 5G plans will receive 18 months of free access to Google’s AI Pro plan, including the Gemini 2.5 Pro model, advanced image/video generation tools, 2TB cloud storage, and expanded NotebookLM features. This offer, valued at ₹35,100 per user, will expand nationwide to all Jio customers rapidly.

Beyond consumer offerings, Reliance Intelligence becomes Google Cloud’s strategic go-to-market partner in India, driving adoption of Gemini Enterprise across Indian organizations and expanding access to Google’s Tensor Processing Units (TPUs) for AI model training. Separately, Morgan Stanley estimates Reliance will invest $12-15 billion in AI infrastructure, including a 1GW data center in Jamnagar that could become the world’s largest. This follows Reliance’s August announcement of a $97 million joint venture with Meta (30% Meta stake) to build enterprise AI solutions.

Stock Performance & Analyst View: Analysts Still Bullish Despite Flat Reaction

Reliance shares opened flat on October 31, touching a day high of ₹1,497.50 before settling at ₹1,488.50, essentially unchanged from the prior close of ₹1,504.20. Trading volume showed no unusual spike, suggesting institutional investors are taking a wait-and-see approach to AI monetization timelines.

Despite the lackluster immediate reaction, analyst sentiment remains constructive. According to Motilal Oswal (October 20, 2025), the stock carries a Buy rating with a ₹1,700 target, implying 14% upside from current levels. HSBC’s Puneet Gulati raised his target to ₹1,750 (17.6% upside) while maintaining Buy. Jefferies analyst Bhaskar Chakraborty reiterated Buy with a ₹1,670 target (12.2% upside). The consensus across 36 analysts shows overwhelming bullishness: 32 Buy ratings, 2 Sells, 1 Hold, with an average 12-month target of ₹1,685 (13.2% upside). However, no analyst has specifically updated targets post-Google partnership announcement, suggesting the market is still digesting the strategic implications.

What This Means for Traders: Long Runway, But When’s the Payoff?

The flat stock reaction tells you everything about trader sentiment right now: this is a multi-year infrastructure bet, not a near-term earnings catalyst. Reliance is essentially subsidizing ₹35,100 per user in AI access to lock customers into its ecosystem—classic telecom playbook, but with unclear monetization timelines. For traders, here’s the critical breakdown:

Bull Case: If AI integration drives ARPU expansion over the next 12-18 months by tying premium AI features to higher-value 5G plans, Reliance could see meaningful revenue acceleration. The enterprise AI angle—becoming Google Cloud’s India partner for Gemini Enterprise—offers high-margin revenue streams that could materialize by FY26-27. The $12-15 billion data center investment positions Reliance as India’s AI infrastructure backbone, potentially unlocking sovereign cloud and enterprise AI contracts.

Bear Case: Free AI access for 18 months means zero immediate revenue. If competitors like Airtel respond with similar AI bundling, this becomes a margin-eroding arms race rather than a differentiation play. The $12-15 billion capex commitment adds to Reliance’s already heavy capital allocation (new energy, retail expansion), potentially delaying free cash flow improvement that analysts are banking on.

Trading Levels: The stock has support around ₹1,475 (where Bank of America bought 295,000 shares in a block deal on October 30). Resistance sits at ₹1,550, a level it failed to breach in late October. For momentum traders, a break above ₹1,550 on volume could signal institutional accumulation ahead of AI monetization clarity. Conservative traders should wait for concrete ARPU data showing AI-driven upgrades, likely visible in Q3 or Q4 FY26 results.

Key Risks to Watch:

- Regulatory headwinds: One conflicting October 31 report cited “changing strategic priorities and ongoing regulatory discussions regarding data privacy and AI governance” as reasons for potential delays in AI tool rollout. If data localization or privacy rules slow deployment, the thesis weakens.

- Monetization lag: If free AI access doesn’t convert to paid premium tiers or higher-value plans by mid-2026, the market will punish the stock for capital misallocation.

- Competitive response: Airtel’s potential AI partnerships (rumored with Microsoft) could neutralize Reliance’s first-mover advantage.

Next Catalysts: Watch for Q3 FY26 earnings (scheduled January 16, 2026) for any commentary on AI-driven ARPU trends or enterprise AI contract wins. The Jio Platforms IPO, scheduled for H1 2026, will be critical—AI integration could significantly boost valuation multiples if the market believes in the platform shift from telecom to AI-powered services.

The Bigger Picture: India’s AI Market Exploding, But Who Captures Value?

India’s AI market is projected to hit $28.8 billion by end-2025 and $54 billion by 2035, growing at 28.69% CAGR. The government’s IndiaAI Mission has received 67 proposals for indigenous AI models, signaling policy support. For Reliance, the competitive landscape includes not just telecom rivals but cloud giants (AWS, Microsoft Azure) and IT services players (TCS, Infosys) all vying for enterprise AI dominance.

The Reliance-Google partnership is infrastructure-heavy, aiming to own the rails of India’s AI economy. If successful, Reliance evolves from a telecom provider to a platform enabler controlling data, connectivity, and AI compute—a $400 billion opportunity by 2030 according to sector projections. But the path from infrastructure investment to bottom-line impact typically takes 3-5 years in capex-intensive plays. That’s why the stock isn’t reacting now—traders are waiting for proof of concept.

The Trading Takeaway

This is a hold-and-watch situation for active traders unless you’re positioning for 12-18 month timeframes. The analyst consensus of ₹1,685-1,750 implies 13-18% upside, but catalysts are quarters away. Aggressive traders could accumulate on dips toward ₹1,475 support, betting on Jio IPO hype and AI monetization clarity by mid-2026. Conservative traders should wait for Q3/Q4 FY26 results showing tangible ARPU lift or enterprise AI revenue before committing capital. The stock won’t break out until the market sees cash flow, not just capex announcements. Until then, Reliance remains a value play trading at 1.8x book, not a momentum trade.

Reliance Industries Stock Price History (as of Oct 31, 2025)

52 Week Range

Low: ₹1114.85

High: ₹1551.00

on Apr 7, 2025

on Jul 9, 2025

52 Week Low to All time High Range

Low: ₹1114.85

All-time High: ₹1608.80

on Apr 7, 2025

on Jul 8, 2024

Recent Returns

1 Week

+2.40%

1 Month

+8.97%

3 Months

+6.92%

6 Months

+5.79%

YTD

+21.71%

1 Year

+9.32%

News based Sentiment:

POSITIVE

RIL’s Strong Q2 & AI Push Boost Investor Confidence

Reliance Industries delivered a strong Q2 FY26 performance with significant revenue and profit growth, coupled with strategic investments in AI and renewable energy. These developments, along with positive analyst ratings and increased domestic investor participation, create a positive outlook for the company’s future.

Reliance Industries – Peer Performance Comparison

Disclaimer: This blog has been written exclusively for educational purposes and does not constitute investment advice or personal recommendations. The author is not SEBI-registered as an investment advisor. Recipients should conduct their own research and consult a qualified, SEBI-registered investment advisor before making any investment decisions. Investments in the securities market are subject to market risks; read all related documents carefully before investing.