Alstone Textiles Share Price Target (2024, 2025, 2030, 2050)

Today in this post I will show you Alstone Textiles Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, 2030, and 2050.

Thanks to these targets, I got the opportunity to invest in stocks before their prices increased. The outcome? I got profits in my pocket!

Now it’s your turn to make a profit and make a decision whether you should buy or if you have this share already then whether to sell or hold this share. This article will help you.

Also if you are thinking of buying it and hold for two years no worries we already gave the Alstone Textiles Share Price Target 2025 below in this article.

Now let’s get into the article.

Company Overview

Alstone Textiles is an Indian company that loves both tradition and new ideas in the textile industry.

They began in 1985 and are experts in many kinds of fabrics, like cotton, silk, synthetics, and ready-made clothes.

At first, they mainly sold fabrics.

Lately, they’ve also stepped into finance, helping with loans through third-party products.

| Company | Details | |

|---|---|---|

| Year | 1995 | |

| Company | Alstone Textiles | |

| Headquarters | Pune, India | New Delhi, India |

| Industry | Textiles | |

| Key Products | Cotton, woolen, art silk, natural silk | |

| Readymade garments, hosiery | ||

| Synthetic fiber and fabrics, mixed fabrics | ||

| Website | http://www.alstonetextiles.in/ | |

| CEO | Deepak Kumar Bhojak |

But, no matter what, their main focus is still textiles, making them a flexible player in the always-changing Indian market.

Company Model

Alstone Textiles is one of the leading brands in the Textiles industry. Their revenue model involves trading cotton, wool, artificial silk, and natural silk.

Now they have also started finance businesses like giving loans through their third-party product model.

The company is dedicated to concentrating mainly on textiles and aims to be among the top 5 leading brands in the textile industry in the future.

Financial Trends

For three years, the company’s financial trends stayed almost the same.

But then, like a lion roaring and making a strong comeback, the company saw a huge increase of 30 crores in just one year.

This is a big achievement for the company.

In 2023, the company did something remarkable, out of the 30 crores they earned, they made a whopping 24 crores in profit! That’s a big achievement

The company’s total value went up from 124 to 149 crores, showing that its assets are growing.

Review the graph stats carefully to plan decisions effectively.

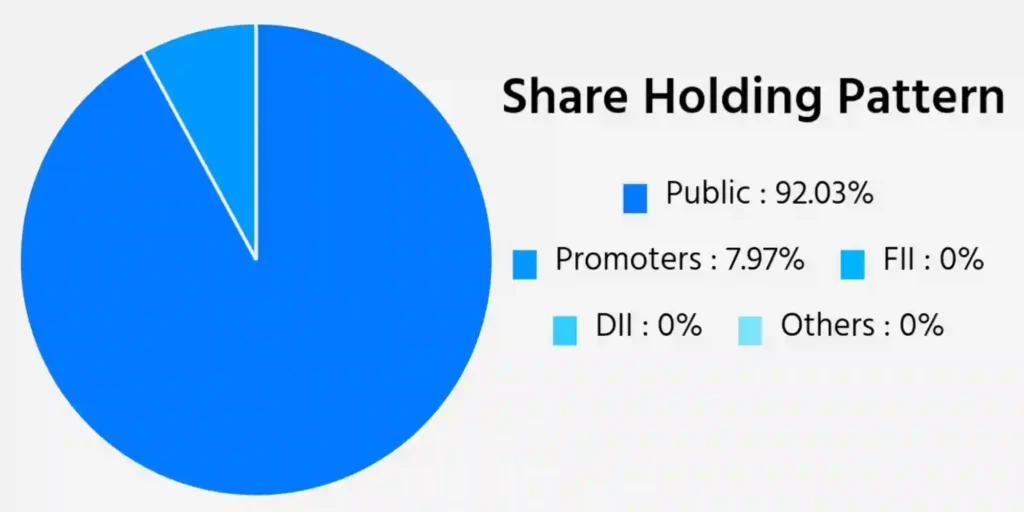

| Category | Percentage |

|---|---|

| Individual Investors | 92.8% |

| Promoters | 2.0% |

| Foreign Institutional Investors (FIIs) | 0.9% |

| Domestic Institutional Investors (DIIs) | 0.3% |

| No Of Shareholders | 2,34,552 |

In 2023, the majority (92.8%) of people own shares in Alstone Textiles, and the remaining portion (7.2%) includes promoters, FIIs, and DIIs.

Fundamentals

Alstone Textiles is a renowned company in the garment business with a market capitalization of ₹167 Cr.

The firm has 127, 48 million shares with profit to earning ratio being 9.56.

The face value of their shares is ₹1.

| Metric | Value |

|---|---|

| Market Cap | ₹167 Cr. |

| Enterprise Value | ₹167.38 Cr. |

| No. of Shares | 127.48 Cr. |

| P/E | 9.56 |

| P/B | 1.11 |

| Face Value | ₹1 |

| Div. Yield | 0% |

| Book Value (TTM) | ₹1.18 |

| Cash | ₹0.14 Cr. |

| Debt | ₹0.52 Cr. |

| Promoter Holding | 7.97% |

| EPS (TTM) | ₹0.14 |

| Sales Growth | 0% |

| ROE | 17.98% |

| ROCE | 17.96% |

| Profit Growth | 0% |

This company does not pay dividends but indicates that they are having no debt at all while being promoted by 7.97%.

Stock Analysis

| Parameter | Stars |

|---|---|

| Ownership | ★★☆☆☆ The ownership structure of the stocks may be a little unstable; thus, it can either rise or fall depending on the one who is holding it. |

| Valuation | ☆☆☆☆☆ Currently, this particular stock is viewed to be more valuable hence indicating higher pricing. |

| Efficiency | ★★☆☆☆ Managing assets seems to be a problem for the company. |

| Financials | ★★★★★ This is on the good side as the firm has been growing steadily with contained debt levels. |

Pros & Cons Of The Company

Pros

- Profit surged by 408.74% in 3 years.

- Revenue soared by 287.37% in the same period.

- Virtually debt-free for financial stability.

- A PEG ratio of 0.03 indicates potential stock undervaluation.

Cons

- ROE at 5.95% signals modest returns on equity.

- A low tax rate of 0.02 contributes to financial advantages.

- EBITDA margin is consistently low at 43.96% over 5 years, pointing to operational challenges.

- Promoter stake dropped from 10.91% to 7.97%, potentially which impacted investors confidence.

| Year | Share Price Target Range |

|---|---|

| 2024 | Rs 1.3 to Rs 1.4 |

| 2025 | Rs 1.4 – Rs 1.6 |

| 2026 | Rs 1.6 – Rs 1.9 |

| 2027 | Rs 1.9 – Rs 2.10 |

| 2028 | Rs 2.1 – Rs 2.5 |

| 2030 | Rs 2.5 – Rs 3.1 |

| 2050 | Rs 10.1 – Rs 11.1 |

Looking at 2024, both the company and my analysis expect good things.

We think the Alstone Textiles share price target in 2024 could be between Rs 1.3 and Rs 1.4.

| Year | Target Range |

|---|---|

| 2024 | Rs 1.3 – Rs 1.4 |

This suggests we’re optimistic about the company doing well next year.

Moving into 2025, both the company and I see more growth ahead.

We predict the Alstone Textiles share price target for 2025 might rise between Rs 1.4 and Rs 1.6.

| Year | Target Range |

|---|---|

| 2025 | Rs 1.4 – Rs 1.6 |

This means we both believe the company will keep doing better in the future.

For 2026, both the company and I expect things to keep getting better.

We’re thinking the share price could be between Rs 1.6 and Rs 1.9.

| Year | Target Range |

|---|---|

| 2026 | Rs 1.6 – Rs 1.9 |

This shows we’re on the same page about the company’s plans for growth.

My estimate for the possible value of Alstone Textiles shares will be somewhere between Rs 1.9 and Rs 2.10 by the year 2027 and Alstone Textiles Share Price Target 2027 may rise too.

| Year | Target Range |

|---|---|

| 2027 | Rs 1.9 – Rs 2.1 |

This is my personal opinion which demonstrates how much I believe the company can do well in that year.

Alstone Textiles Share Price Target 2028 would rise by 300 paise, that is they can trade its stocks at a range of Rs 2.1 to Rs 2.5 per unit on average.

| Year | Target Range |

|---|---|

| 2028 | Rs 2.1 – Rs 2.5 |

It’s me expecting growth on these terms for the company’s shares in this period.

For 2030, I estimate that the Alstone Textiles Share Price Target 2027 could fall between Rs 2.5 and Rs 3.2.

| Year | Target Range |

|---|---|

| 2030 | Rs 2.5 – Rs 3.2 |

This is what I think will happen to the value of these shares in the future, as suggested by me.

The Alstone Textiles Share Price Target 2050 value might range from Rs 10.1 to Rs 11.1 after a long time following an increase with an important margin by 2050.

| Year | Target Range |

|---|---|

| 2050 | Rs 10.1 – Rs 11.1 |

That is my ambitious optimism indicating a great increase in value over several decades.

FAQ You May Ask Us

In 2024, Alstone Textiles thinks its shares might be valued between Rs 1.3 and Rs 1.4.

For 2025, they hope their shares will be worth more, aiming for Rs 1.4 to Rs 1.6.

What about 2030? What are they aiming for?

In 2030, Alstone Textiles can grow between Rs 2.5 and Rs 3.1. It can be more in future too.

Conclusion

So finally we are here and discussing all the points about Alstone Textiles’ Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030)

Now, it’s your turn to decide whether to buy, sell or hold the share:

What’s your key thought on Alstone Textiles’ share prices?

Also Read:

Feel free to drop your thoughts or questions in the comments below.