Buy or Sell After 9 Days of Decline? » Sharedhan

Tata Motors Share Price has been under pressure for the past nine days, leaving many investors wondering whether this is the right time to buy the stock. The stock has seen continuous declines, raising concerns and curiosity among potential buyers.

Those who were waiting for a correction from higher levels are now asking whether this is the golden opportunity to enter. Let’s dive deep into the factors behind this decline and evaluate if it’s the right time to make a purchase.

Tata Motors Share Price Decline

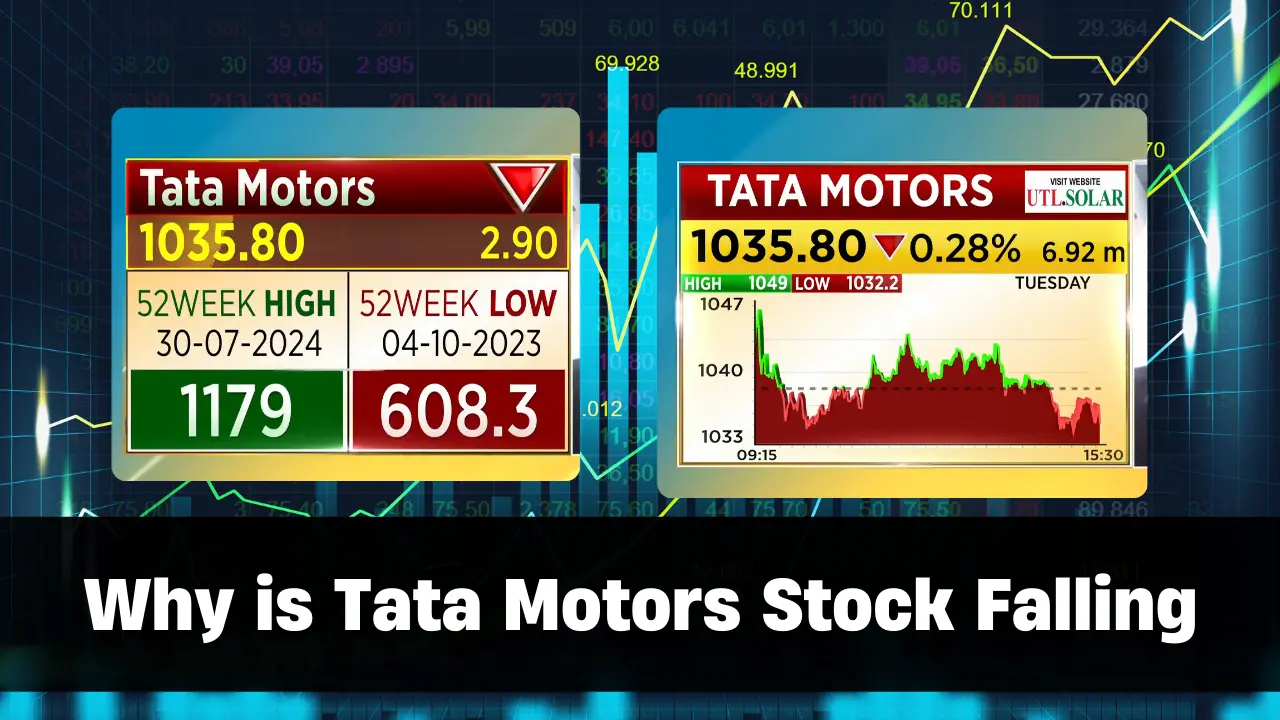

Over the last nine days, Tata Motors’ shares have fallen consistently. If we examine the last 12 days, the stock has closed in the red on 11 of those days. Today, the stock fell by over 6%, and the intraday low was ₹975. From its peak of ₹1,079 on July 30, the stock has dropped around 17%. Over the past five days alone, it has witnessed a 10% decline, and in the last six months, the stock has also faced considerable downward pressure.

Such a sharp correction raises questions among both new and seasoned investors. Is this just a temporary setback, or is there something more fundamental behind this fall? Understanding the reasons behind this drop is crucial before making any investment decisions.

Why is Tata Motors Stock Falling

There are a few significant reasons behind Tata Motors’ recent decline. One major factor is a report released by UBS, which maintained a “sell” rating on the stock. UBS cited concerns about Tata Motors’ luxury vehicle segment, Jaguar Land Rover (JLR), and the margins of its domestic passenger vehicle (PV) business.

1. Pressure on Jaguar Land Rover (JLR)

During the semiconductor chip shortage, JLR shifted its focus toward higher-margin premium vehicles, which led to an increase in both average selling prices and margins. The average selling price (ASP) of JLR’s cars rose from £23,000 to £49,000 and further to £72,000 during that period. Additionally, JLR’s margins improved significantly, witnessing around a 44% increase.

However, the demand for premium models has now started to decline, and JLR’s order book has dropped below pre-COVID levels. At the end of Q4, JLR had an order book of 133,000 units, but this number has reduced to approximately 100,000 units as per the latest numbers for the first quarter. This decrease in demand and growing discounts have created a downward pressure on margins, contributing to the stock’s decline.

2. Domestic Passenger Vehicle Segment

Tata Motors has also been offering significant discounts in the domestic passenger vehicle segment to boost sales. Even before the start of the festive season, Tata Motors has rolled out substantial offers. Discounts as high as ₹1,80,000 are being offered on models like the Tata Harrier, with exchange bonuses of up to ₹45,000. These offers are meant to stimulate sales during a time when the company has seen a slowdown.

Tata Motors experienced a 4.5% decline in sales in August, marking the third monthly drop in this financial year. This trend has raised concerns about the company’s domestic sales performance. The company’s decision to offer discounts ahead of the festive season suggests that it is feeling the pressure of declining sales and might face further challenges in maintaining its margins.

What Do Experts Say?

Experts are split on whether this is a good time to buy Tata Motors’ stock. Santosh Meena, Head of Research at Swastika Investmart, suggests that investors should keep a close eye on the ₹940 level, which is the stock’s 200-day moving average (DMA). This level is considered a make-or-break point for the stock.

According to Meena, if Tata Motors’ share price falls below ₹940, the stock could further drop to levels around ₹840 or even ₹800. However, if the stock manages to hold above ₹940, it could signal a buying opportunity. For those looking to make a fresh entry, it is advised to wait and see whether the stock sustains above the ₹940 level before making a decision.

Long-term investors should continue holding their positions, keeping the ₹940 level in mind. However, short-term traders should consider this level as a key indicator before making any moves.

What Should Investors Do Now

Given the current situation, there are a few key factors to consider before deciding whether to buy Tata Motors’ stock:

1. Wait for Stability Around ₹940

The ₹940 level is critical for Tata Motors. If the stock stabilizes around this point and does not fall below, it could be an indication that the worst is over. Investors should keep a close watch on how the stock performs over the next few trading sessions. If it holds above this level, it might be a good time to enter.

2. Monitor JLR’s Performance

JLR’s performance will continue to play a significant role in Tata Motors’ overall financial health. Investors should keep an eye on JLR’s sales numbers and order book updates in the coming months. If the demand for premium vehicles improves, it could provide a boost to Tata Motors’ margins and stock price.

3. Evaluate the Impact of Discounts

Tata Motors’ strategy of offering deep discounts on its domestic passenger vehicles is aimed at boosting sales during a challenging period. While this might help in the short term, it could put additional pressure on margins. Investors should assess whether the discounts lead to a significant increase in sales or if they result in further margin erosion.

4. Be Cautious of Broader Market Trends

The automotive sector, like many others, is influenced by broader market trends, including inflation, interest rates, and global economic conditions. Any further disruptions in the supply chain, inflationary pressures, or an economic downturn could impact Tata Motors’ stock. Investors should be mindful of these external factors when making their decisions.

Disclaimer– I would like to remind you that I am not authorized by SEBI to provide any financial advice or recommendations. These are only provided for informational purposes. It does not constitute a recommendation to buy, sell, or hold Dabur India stock. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions— Sharedhan.com