Nifty Closed at ₹24,290.80 (+0.69%) with HCL Tech closing higher for the past 5 consecutive trading days. Discover Top Stocks to Watch!

Show Table of Contents

Top Indices Performance Overview

Nifty 50 Performance Overview

The Nifty 50 kicked off the day at ₹24,277.09, showing some spirited movement throughout the session. It dipped to a low of ₹24,209.80 before rallying to a high of ₹24,308.44. By the closing bell, it settled at ₹24,290.80, marking a +0.69% gain for the day.

The day’s performance was influenced by a mix of gainers and losers, creating a dynamic trading environment.

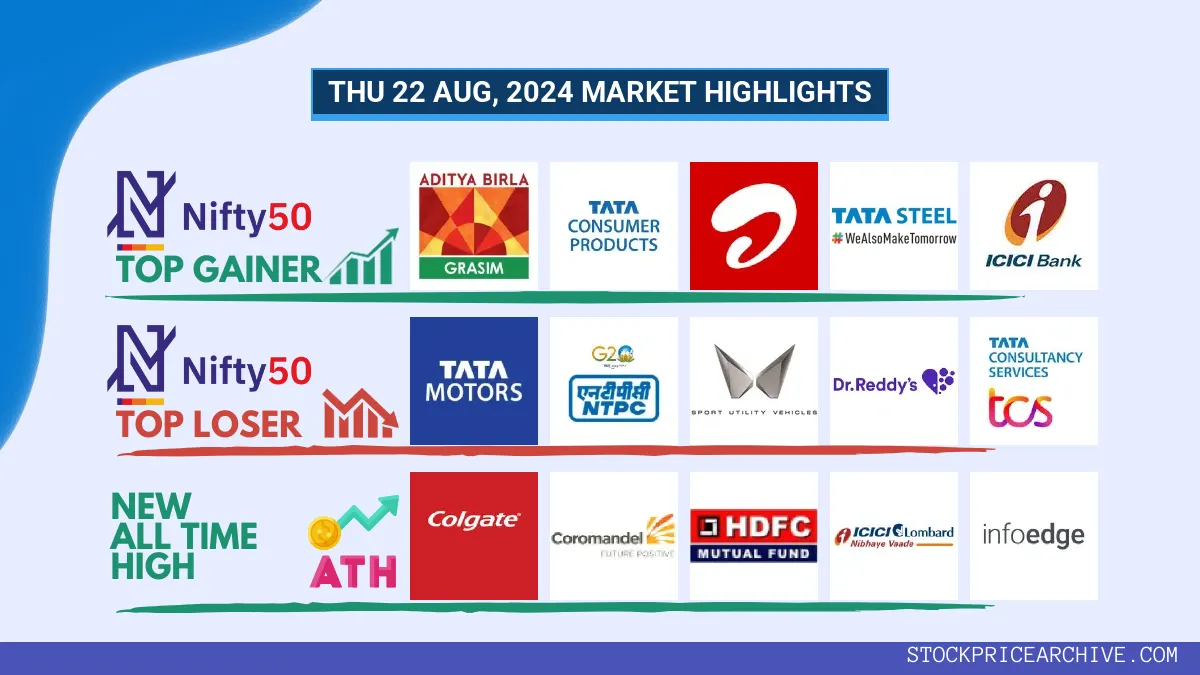

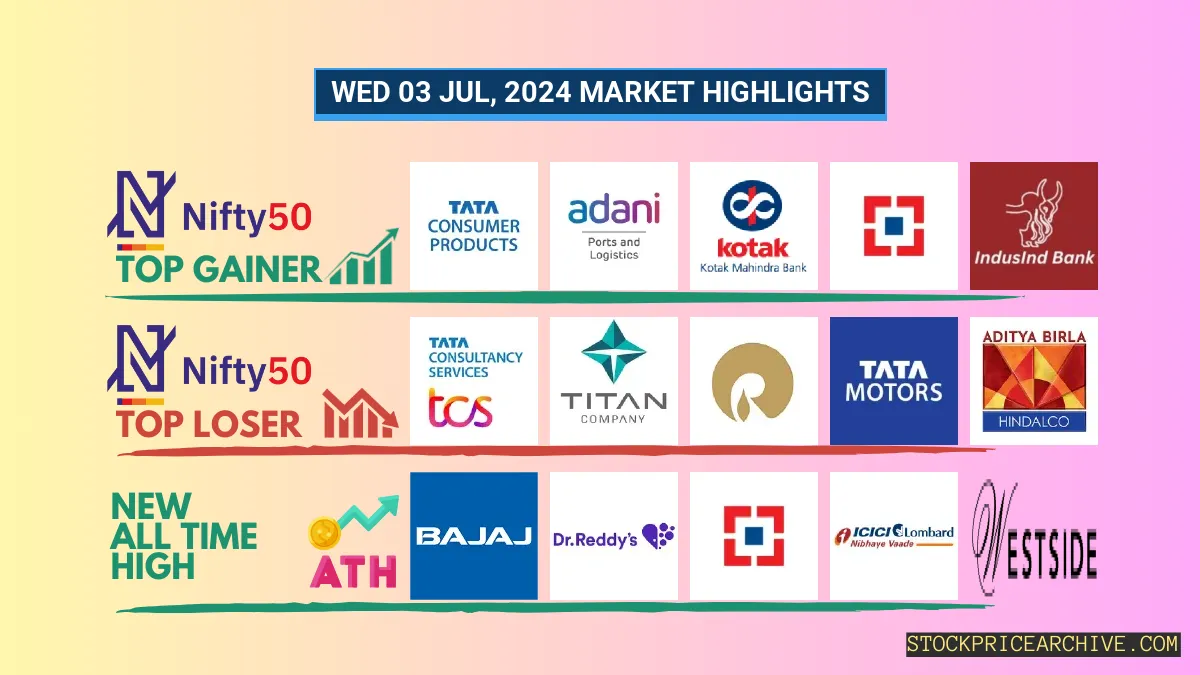

Nifty 50 Top Gainers

Nifty 50 Top Losers

Nifty 50 Stocks To Watch for Tomorrow

HCL Technologies: A Look at the Bullish Trend

- Performance Overview: In the last 26 trading sessions (as of July 3, 2024), HCL Technologies has closed higher than the previous day 16 times, indicating a positive trend.

- Recent Trend: HCL has been on a roll, closing higher for the past 5 consecutive trading days, starting from June 26, 2024.

- Returns: If you had invested ₹10,000 in HCL over the past 26 trading sessions, your investment would have grown to ₹10,921, reflecting a 9.21% return.

- Financial Insight: Over the past year, HCL has generated a strong revenue of ₹1,10,741.46 Crore and a profit of ₹15,822.59 Crore.

- As of July 3, 2024, HCL has a Market Capital of ₹3,97,763.09 Crore.

- Summary: The recent performance of HCL Technologies suggests a strong bullish pattern. Investors are advised to keep an eye on the company’s price movements to identify potential short-term and long-term growth opportunities. Learn about HCL’s potential target for tomorrow and explore the potential targets for HCL in 2024 and 2025.

HCL Financial Performance

➲ Divis Lab (Showing Signs of a Downturn)

- Performance Overview: Over the last 26 trading days, Divis Lab’s share price has closed higher 14 times and lower 12 times. This suggests some volatility in the stock’s performance.

- Recent Trend: Divis Lab has seen a slight dip in its share price over the last two days, with no gains since Monday, July 1st, 2024.

- Returns: Over the past 26 trading sessions, Divis Lab has delivered a positive return of 7.57%. This means that if you had invested ₹10,000, your investment would be worth ₹10,757 today.

- Financial Insight: Divis Lab has shown strong financial performance over the past year, generating a revenue of ₹7,844.99 Crore and achieving a profit of ₹1,600 Crore.

- As of Wednesday, July 3rd, 2024, Divis Lab has a Market Capital of ₹1,20,731.32 Crore.

- Summary: While Divis Lab has experienced some recent downward movement, its overall performance remains solid. It’s worth keeping a close eye on the stock’s short-term trajectory. For insights on potential future price movements, check out our projections for Divis Lab’s Target for Tomorrow and Divis Lab Targets for 2024 & 2025.

Divis Lab Financial Performance

Nifty 500 Performance Overview

The Nifty 500 kicked off the day at ₹22,820.55, displaying a spirited performance. While it encountered some bumps along the way, reaching a low of ₹22,765, it ultimately rallied to a high of ₹22,871.5 before settling at a close of ₹22,856.94 (+0.78%).

Take a look at the top gainers and losers – their movement played a key role in the Nifty 500’s journey today.

Nifty 500 Top Gainers

Nifty 500 Top Losers

Nifty 51 to 500 Stocks To Watch for Tomorrow

➲ MphasiS (Looking Bullish)

- Recent Performance: MphasiS has shown some strong momentum! In the last 26 trading sessions, it closed higher 16 times and lower 10 times.

- Hot Streak: MphasiS is on a roll, with a 7-day green streak – no red days since Monday, June 24th, 2024.

- Returns: Over the past 26 trading sessions, MphasiS has delivered a 4.78% return. This means an investment of ₹10,000 would be worth ₹10,478 today.

- Financial Snapshot: Over the past year, MphasiS generated impressive revenue of ₹13,278.51 Crore and a profit of ₹1,554.81 Crore.

- Market Value: As of Wednesday, July 3rd, 2024, MphasiS has a Market Capitalization of ₹46,445.99 Crore.

- Looking Ahead: MphasiS is showing some strong signs and its bullish pattern makes it a stock worth watching. If you’re interested in exploring potential price targets, check out these links: MphasiS Target for Tomorrow and MphasiS Targets for 2024 & 2025.

MphasiS Financial Performance

➲ Ashok Leyland (Showing Bearish Trends)

- Performance Snapshot: Over the past 26 trading days, Ashok Leyland has seen 13 days where the share price closed higher and 13 days where it closed lower.

- Recent Activity: Ashok Leyland has been on a downward trend for the past four trading days, with the share price closing lower each day since Thursday, June 27th, 2024.

- Returns Breakdown: During this recent 26-day period, Ashok Leyland provided a return of 0.86%. This means that if you had invested ₹10,000, your investment would be worth ₹10,086 today.

- Financial Highlights: Looking at the past 12 months, MphasiS generated a revenue of ₹45,790.63 Crore and recorded a profit of ₹2,483.51 Crore.

- As of Wednesday, July 3rd, 2024, MphasiS has a Market Capital of ₹71,085.09 Crore.

- Summary: Ashok Leyland is currently experiencing a bearish trend. It’s wise for investors to keep a close eye on the stock’s performance. You can find potential target prices for tomorrow and projected target prices for 2024 and 2025 on our website.

Ashok Leyland Financial Performance

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores