Green Streak Continues to 8-Day Rally

Top Indices Performance Overview

Nifty 50 Performance Overview

The Nifty 50 opened the day at ₹22,455. Throughout the session, it experienced fluctuations,

hitting a low of ₹22,427.75

and reaching a high of ₹22,529.95, before finally settling at a close of ₹22,469.05 (+0.63%).

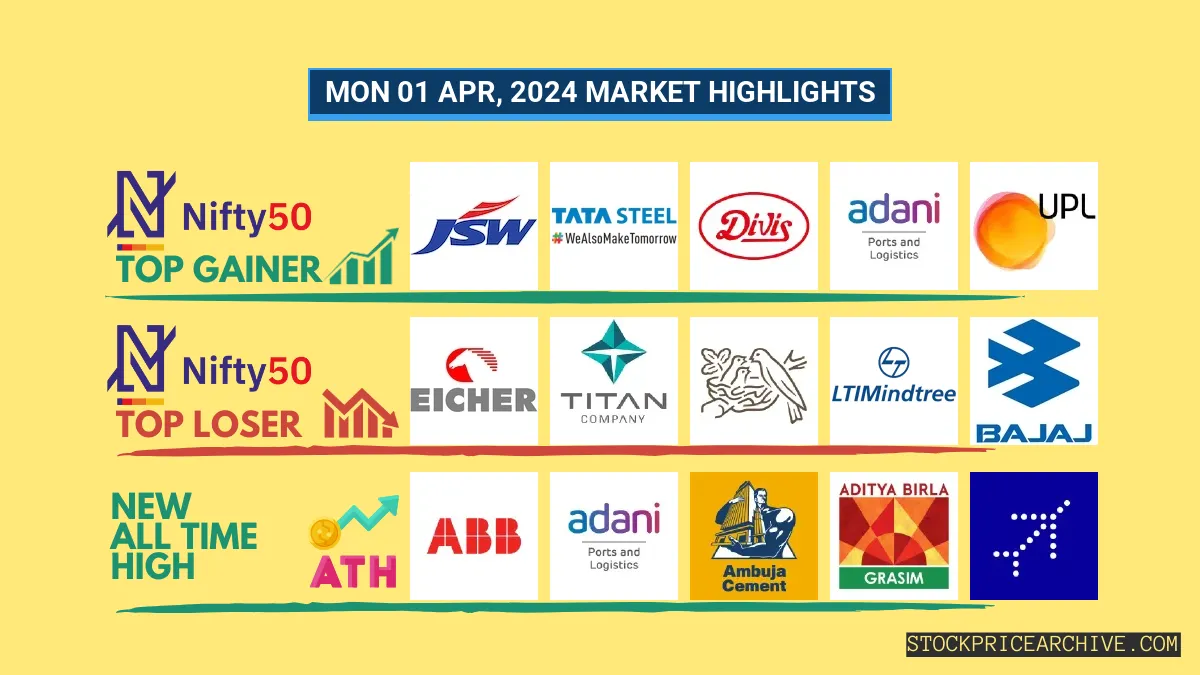

Lets take a look at the top gainers and losers stocks that influenced the today’s Nifty 50 movement.

Nifty 50 Top Gainers

Nifty 50 Top Losers

Nifty 50 Stocks To Watch for Tomorrow

➲ Bajaj Finance (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Bajaj Finance has closed in green 15 times and in red 8 times.

- Recent Trend: Bajaj Finance has been on a 8-day green streak, without a single day

closing in red since Mon 18 Mar, 2024. - Returns: Bajaj Finance gave a 8.38% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹10,838

- Financial Insight: Bajaj Finance reported a net profit of ₹3,638.95 Crore in 2023-Q3 Income Statement.

- Summary: Bajaj Finance exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects:

Checkout Bajaj Finance Target for Tomorrow

and Bajaj Finance Targets for 2024 & 2025.

➲ Tech Mahindra (Bearish Pattern)

- Performance Overview: In the last 23 trading sessions, Tech Mahindra has closed in red 16 times and in green 7 times.

- Recent Trend: Tech Mahindra has been on a 5-day red streak, without a single day closing in green since Thu 21 Mar, 2024.

- Returns: Tech Mahindra gave a -5.9% returns in the last 23 trading sessions, that means your investment of 10,000 would have become 9,410

- Financial Insight: Tech Mahindra reported a net profit of 523.70 Crore in 2023-Q3 Income Statement.

- Summary: Tech Mahindra is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Tech Mahindra Target for Tomorrow

and Tech Mahindra Targets for 2024 & 2025.

Nifty 500 Performance Overview

The Nifty 500 opened the day at ₹20,392.25. Throughout the session, it experienced fluctuations,

hitting a low of ₹20,392.25

and reaching a high of ₹20,504.45, before finally settling at a close of ₹20,496.50 (+1.19%).

Lets take a look at the top gainers and losers stocks that influenced the today’s Nifty 500 movement.

Nifty 500 Top Gainers

Nifty 500 Top Losers

Nifty 500 Stocks To Watch for Tomorrow

➲ Bajaj Finance (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Bajaj Finance has closed in green 15 times and in red 8 times.

- Recent Trend: Bajaj Finance has been on a 8-day green streak, without a single day

closing in red since Mon 18 Mar, 2024. - Returns: Bajaj Finance gave a 8.38% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹10,838

- Financial Insight: Bajaj Finance reported a net profit of ₹3,638.95 Crore in 2023-Q3 Income Statement.

- Summary: Bajaj Finance exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects:

Checkout Bajaj Finance Target for Tomorrow

and Bajaj Finance Targets for 2024 & 2025.

➲ Vinati Organics (Bearish Pattern)

- Performance Overview: In the last 23 trading sessions, Vinati Organics has closed in red 18 times and in green 5 times.

- Recent Trend: Vinati Organics has been on a 8-day red streak, without a single day closing in green since Mon 18 Mar, 2024.

- Returns: Vinati Organics gave a -11.49% returns in the last 23 trading sessions, that means your investment of 10,000 would have become 8,851

- Financial Insight: Vinati Organics reported a net profit of 76.94 Crore in 2023-Q3 Income Statement.

- Summary: Vinati Organics is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Vinati Organics Target for Tomorrow

and Vinati Organics Targets for 2024 & 2025.

Disclaimer: Information is provided ‘as is’ and solely for informational and educational purposes, not for trading purposes or advice. We highly recommend to do your own research before making any investment.