HCC Share Price Target (2024, 2025, 2027, 2030 to 2050)

Today we will try to do a prediction for Hindustan Construction HCC Share Price Target for the year 2024, 2025, 2027, 2030 to 2050.

I studied almost allover the internet and gathered some best information you should note before making your decision of buying selling and holding the stock.

There are many reports, pros and cons study you should know which we are going to discuss in this HCC Share Price Target (2024, 2025, 2027, 2030 to 2050) article.

So let’s dive right into it.

What Is HCC?

Hindustan Construction Company is leading construction company in india since 1926. Which made the best construction in India including Nathpa Jhakri Hydro Power Station in Himachal Pradesh and the Bandra-Worli Sea Link in Mumbai.

Main business

- Real estate

- Transportation (roads and bridges)

- Urban infrastructure

- Hydropower

- Industrial and buildings

Projects:

- Bandra-Worli Sea Link, Mumbai

- Delhi Airport Metro Express Line

- Nathpa Jhakri Hydro Power Station, Himachal Pradesh

- Mumbai Trans-Harbour Link

- Chennai Metro Rail Project

| Category | Details |

|---|---|

| Founded | 1926 |

| Headquarters | Mumbai, India |

| Website | https://www.hccindia.com/ |

| CEO | Arjun Dhawan |

| Employees | Over 10,000 |

| Main Business Areas | Transportation, Hydropower, Urban Infrastructure, Industrial & Buildings, Real Estate |

| Key Projects |

|

| Global Presence | India, UAE, Sri Lanka |

Also now they started taking international projects some of there starter countries are Sri Lanka & UAE.

History Of HCC

| Year | Event |

|---|---|

| 1926 | Founded by Seth Walchand Hirachand |

| 1927 | Got there first project of Walchand Hirachand Stadium, Pune |

| 1936 | Also got Mulshi Dam construction which entered them in large scale construction buissness |

| 1947 | They did a major Role in rebuilding war-torn infrastructure after our country got independence |

| 1950 – 1960 | They contributed to industrialization by constructing dams, power stations, factories |

| 1960 – 1970 | Got into transportation buissness by bridges and roads |

| 1980s | International ventures: Middle East, Southeast Asia |

| 1991 | Indian economy opening leads to new opportunities in there buissness. |

| 1990 – 2000 | Projects: Bandra-Worli Sea Link, Nathpa Jhakri Hydro Power Station |

| 2000 – 2010 | Up and downs comes after some time in company due to global slowdown and also project delays |

| 2010 -Present | Major activites done in this company to regrow better like they did Restructuring, debt reduction and strategic partnerships |

| 2023 | Arjun Dhawan appointed CEO |

Financial Trends

Financial Trends of HCC is quite interesting the company made huge revenue numbers in the year 2022 but got to see some decrease by -8.44264%. But it will be interesting to see the 2024 numbers soon.

The company is in loss by -26.59 Cr comparing to 2022 year 2023 for them got really bad. They got there differences by -104.887% and that is so much loss for a company. Let’s see the future year how the company will perform.

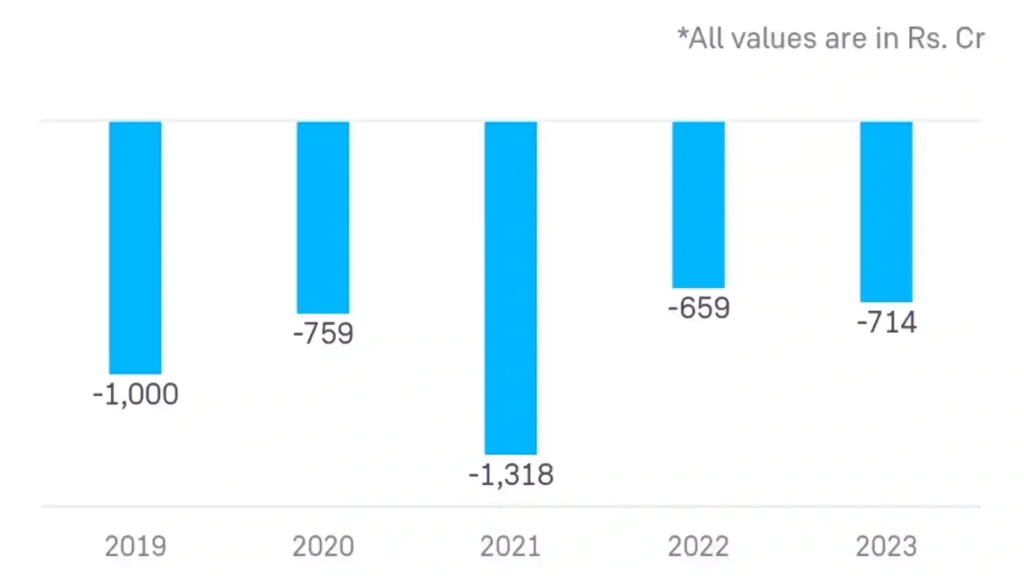

Networth is alltime decreasing as seeing the graphs we can conclude the company is graph of 5 years is quite bad. But seeing the stats I can say they are making a comeback soon. You can take a look at there annual reports from here.

Share holdings of HCC Hindustan Construction Company is perfect. The company is own by public by almost 64.19%, 18.59% by promoters, Domestic Institutional Investors 9.39% and at last Foreign Institutional Investors by 7.84%.

Pros & Cons

Pros

- Healthy ROCE of 21.66% over the past 3 years

- Strong operating leverage at 27.23

- Strong profit growth of 51.86% over the past 3 years

- Low PEG ratio of 0.15, indicating potential undervaluation

Cons

- Poor revenue growth of only 12.71% over the past 3 years

- Negative ROE of -16.33% over the past 3 years

- Low tax rate of 0.58%

The HCC Share Price Target will increase and also will fall in some years so before taking the decision don’t follow this targets only do your research also.

| Year | Initial Target | Mid-Year Target | Year-End Target |

|---|---|---|---|

| 2024 | ₹41.79 | ₹57.36 | ₹57.38 |

| 2025 | ₹61.78 | ₹61.14 | ₹61.14 |

| 2026 | ₹67.83 | ₹67.15 | ₹67.16 |

| 2027 | ₹74.17 | ₹73.50 | ₹73.50 |

| 2028 | ₹80.85 | ₹80.17 | ₹80.18 |

| 2029 | ₹87.84 | ₹87.19 | ₹87.16 |

| 2030 | ₹95.19 | ₹94.54 | ₹94.53 |

| 2050 | ₹195.57 | ₹183.67 | ₹195.37 |

| HCC Share Price Target 2024 Month-Wise | Target Range |

|---|---|

| January | ₹41.79 – ₹43.16 |

| February | ₹43.16 – ₹41.80 |

| March | ₹41.80 – ₹41.11 |

| April | ₹41.11 – ₹44.88 |

| May | ₹44.88 – ₹57.36 |

| June | ₹57.36 – ₹57.37 |

| July | ₹57.37 – ₹57.37 |

| August | ₹57.37 – ₹57.39 |

| September | ₹57.39 – ₹57.38 |

| October | ₹57.38 – ₹57.39 |

| November | ₹57.39 – ₹57.38 |

| December | ₹57.38 |

This year the HCC Share Price Target 2024 is going to be stable and we can see a huge price increase in May month so just keep observing the charts and make your decision as soon as possible.

| HCC Share Price Target 2025 Month-Wise | Target Range |

|---|---|

| January | 61.78 – 63.16 |

| February | 63.16 – 61.81 |

| March | 61.81 – 61.13 |

| April | 61.13 – 61.14 |

| May | 61.14 – 61.14 |

| June | 61.14 – 61.13 |

| July | 61.13 – 61.14 |

| August | 61.14 – 61.15 |

| September | 61.15 – 61.14 |

| October | 61.14 – 61.15 |

| November | 61.15 – 61.14 |

| December | 61.14 |

If you are targeting and studied the HCC Share Price Target 2025 table so I think you will get your answer this year the price will not increase and holding this year will be a time waste. But if you are focusing on long-term then this one can become a game changer for you.

| HCC Share Price Target 2030 Month-Wise | Target |

|---|---|

| January | ₹95.19 – ₹96.56 |

| February | ₹96.56 – ₹95.19 |

| March | ₹95.19 – ₹94.52 |

| April | ₹94.52 – ₹94.53 |

| May | ₹94.53 – ₹94.54 |

| June | ₹94.54 – ₹94.54 |

| July | ₹94.54 – ₹94.53 |

| August | ₹94.53 – ₹94.54 |

| September | ₹94.54 – ₹94.54 |

| October | ₹94.54 – ₹94.54 |

| November | ₹94.54 – ₹94.53 |

| December | ₹94.53 |

The HCC Share Price Target 2030 will also be not that much growing it will not grow but it will be reduced by 1-2 Rs. But thinking of it as investing in 2024 and selling it in 2030 will be so much more profitable after 6 Years the price will increase and you will get almost 131.707% which is huge.

| HCC Share Price Target 2050 Month-Wise | Target Price Range |

|---|---|

| January | ₹197.57 – ₹177.57 |

| February | ₹177.57 – ₹213.57 |

| March | ₹213.57 – ₹212.57 |

| April | ₹212.57 – ₹195.57 |

| May | ₹195.57 – ₹185.00 |

| June | ₹185.00 – ₹178.57 |

| July | ₹178.57 – ₹182.57 |

| August | ₹182.57 – ₹183.57 |

| September | ₹183.57 – ₹170.57 |

| October | ₹170.57 – ₹204.57 |

| November | ₹204.57 – ₹197.57 |

| December | ₹197.57 – ₹197.57 |

The HCC Share Price Target 2050 is almost 26 years the price will increase by 375.61% which is also good not bad. So take note of this stock and also try to add it to your portfolio.

FAQ You May Ask Us

The future of this stock is very bright as it will grow by 131.707% if you invest till 2030 from now that is 2024.

The HCC Share Price Target 2024 is going to be from 41.79 which is good for a stock for its early price.

The HCC Share Price Target 2024 is going to from 61₹ which is almost a 48.7805% increase will be good for a stock to grow that much in its early price stage.

Conclusion

So finally we have discussed all HCC Share Price Target for the years 2024, 2025, 2027, 2030 to 2050.

Now it’s your turn to decide whether to buy, sell, or hold this stock.

Do some more research and yes don’t follow our Table Target blindly as we have done so much research but it doesn’t mean we are 100% correct.

Also read:

Comment to me about your decision whether you are going to buy, sell, or hold this stock.

![How to become a chess grandmaster [Criteria, Goals & Salary] How to become a chess grandmaster [Criteria, Goals & Salary]](https://awareearth.org/wp-content/uploads/23264.952780f1.668x375o.92c52a8f9f37@2x-jpeg.webp)