Metal & Auto Stocks Lead Selloff as JSW Steel (-7.87%) & Tata Motors (-5.62%) Tumble

Show Table of Contents

Top Indices Performance Overview

Nifty 50 Performance Overview

The Nifty 50 started the day at ₹24,323.69, showcasing a bit of a roller coaster ride. It dipped to a low of ₹23,893.69 before climbing to a high of ₹24,350.05. By the closing bell, the index settled at ₹24,051.8, down 2.7% for the day.

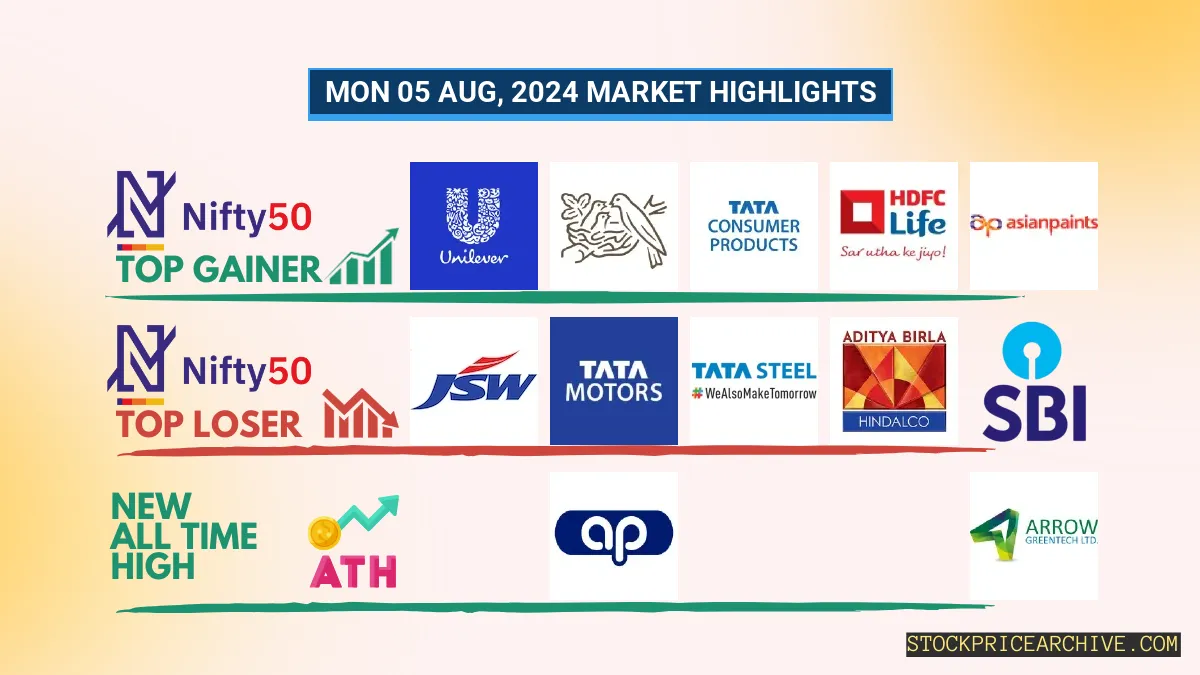

This movement was influenced by a mix of top gainers and losers, which you can find in the table below.

Nifty 50 Top Gainers

Nifty 50 Top Losers

Nifty 50 Stocks To Watch for Tomorrow

Nestle India (Bullish Pattern)

- Performance Overview: In the last 25 trading days, Nestle India closed higher 11 times and lower 14 times.

- Recent Trend: Nestle India has been on a 3-day winning streak, with no closing losses since Wednesday, July 31, 2024.

- Returns: Over the past 25 trading days, Nestle India generated a return of -1.77%. This means an investment of ₹10,000 would be worth ₹9,823 today.

- Financial Insight: Over the past year, Nestle India generated revenue of ₹19,665.02 Crore and achieved a profit of ₹3,244.46 Crore.

- As of Monday, August 5, 2024, Nestle India has a Market Capital of ₹2,40,846.42 Crore.

- Summary: Nestle India shows a strong bullish pattern. Keep an eye on its price movements for both short-term and long-term growth potential. Check out Nestle India Target for Tomorrow and Nestle India Targets for 2024 & 2025 for more insights.

Nestle India Financial Performance

➲ GRASIM (Bearish Pattern)

- Performance Overview: Over the past 25 trading days, GRASIM’s stock has closed lower 15 times and higher 10 times.

- Recent Trend: GRASIM has been on a downward trend, closing lower for the past six trading days, with the last green day being Friday, July 26, 2024.

- Returns: In the last 25 trading sessions, GRASIM has yielded a return of -1.92%. This means an investment of ₹10,000 would be worth ₹9,808 today.

- Financial Insight: Over the last year, GRASIM has generated revenue of ₹1,30,978.48 Crore and earned a profit of ₹5,624.48 Crore.

- As of Monday, August 5, 2024, GRASIM has a Market Capital of ₹1,83,406.48 Crore.

- Summary: GRASIM is currently in a bearish phase. Investors should keep a close eye on its performance, particularly the GRASIM Target for Tomorrow and GRASIM Targets for 2024 & 2025.

GRASIM Financial Performance

Nifty 500 Performance Overview

The Nifty 500 kicked off the day at ₹22,772.55, showing a bit of a roller coaster ride throughout the session. It dipped to a low of ₹22,397.69 before reaching a peak of ₹22,868.34. The index eventually closed at ₹22,542.44, down 3.09% from its starting point.

The movement was influenced by the top gainers and losers, which you can find in the table below.

Nifty 500 Top Gainers

Nifty 500 Top Losers

Nifty 51 to 500 Stocks To Watch for Tomorrow

Ajanta Pharma (Bullish Pattern)

- Performance Overview: In the last 24 trading sessions, Ajanta Pharma has closed higher 17 times and lower 7 times.

- Recent Trend: Ajanta Pharma has been on a 3-day winning streak, without a single day closing lower since Tuesday, July 16, 2024.

- Returns: Ajanta Pharma delivered a 24.3% return in the last 24 trading sessions, meaning an investment of ₹10,000 would have grown to ₹12,429.99.

- Financial Insight: Over the past 12 months, Ajanta Pharma has generated revenue of ₹4,332.58 Crore and achieved a profit of ₹853.82 Crore.

- As of Monday, August 5, 2024, Ajanta Pharma has a Market Capital of ₹35,341.25 Crore.

- Summary: Ajanta Pharma presents a strong bullish pattern. Investors should keep an eye on its price movements for both short-term and long-term growth opportunities: Checkout Ajanta Pharma Target for Tomorrow and Ajanta Pharma Targets for 2024 & 2025.

Ajanta Pharma Financial Performance

➲ Astral (Bearish Pattern)

- Performance Overview: Over the last 25 trading days, Astral has ended the day lower than the previous day 18 times, and higher 7 times.

- Recent Trend: Astral has been on a downward trend for the past 6 days, with no positive closing since Friday, July 26, 2024.

- Returns: In the last 25 trading days, Astral has delivered a return of -11.54%. This means an investment of ₹10,000 would have become ₹8,846.

- Financial Insight: In the past 12 months, Astral has generated revenue of ₹5,641.39 Crore and a profit of ₹546.1 Crore.

- As of Monday, August 5, 2024, Astral has a Market Capital of ₹57,229.63 Crore.

- Summary: Astral is currently facing a bearish trend. It’s a good idea for investors to stay informed and monitor the situation closely. You might want to check out the Astral Target for Tomorrow and Astral Targets for 2024 & 2025 for additional insights.

Astral Financial Performance

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores