Nifty Closed at ₹24,304.65 (+0.07%), HCL Technologies shows a strong bullish pattern, while TITAN is trending downwards.

Show Table of Contents

Top Indices Performance Overview

Nifty 50 Performance Overview

The Nifty 50 started the day at ₹24,369.59, showing its usual dynamism with some ups and downs throughout the session. It dipped to a low of ₹24,281.19 before rallying to a high of ₹24,400.65. By the closing bell, it had settled at ₹24,304.65, a gain of +0.07% for the day.

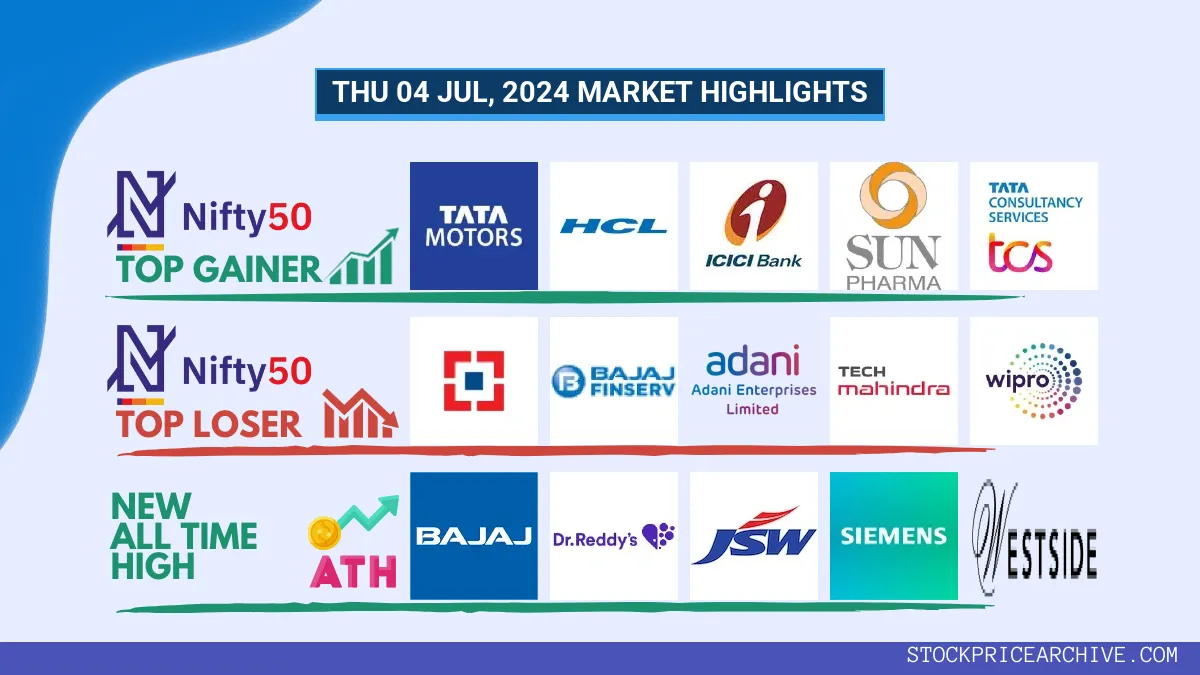

Let’s take a look at the top gainers and losers that contributed to the Nifty 50’s performance today.

Nifty 50 Top Gainers

Nifty 50 Top Losers

Nifty 50 Stocks To Watch for Tomorrow

HCL Technologies (Bullish Pattern)

- Performance Overview: Over the past 26 trading days (from June 10th to July 4th, 2024), HCL has closed higher 16 times and lower 10 times.

- Recent Trend: HCL has been on a winning streak, closing higher for the last six consecutive trading days, starting on Wednesday, June 26th, 2024.

- Returns: If you had invested ₹10,000 in HCL 26 trading days ago, your investment would have grown to ₹11,127, representing a return of 11.27%.

- Financial Insight: In the past year, HCL generated a revenue of ₹1,10,844.97 Crore and a profit of ₹15,837.38 Crore.

- As of Thursday, July 4th, 2024, HCL has a market capitalization of ₹3,99,279.57 Crore.

- Summary: HCL’s recent performance indicates a strong bullish trend. Investors may want to consider monitoring its price movements to identify potential opportunities for both short-term and long-term growth. Checkout HCL Target for Tomorrow and HCL Targets for 2024 & 2025.

HCL Financial Performance

➲ TITAN (Bearish Trend)

- Recent Performance: TITAN has been on a bit of a roller coaster ride lately. Over the past 26 trading sessions (from June 9th to July 4th), it has closed higher 11 times and lower 15 times.

- Short-Term Trend: Looking at the most recent trading days, TITAN has been trending downward. It’s been on a three-day losing streak, closing lower every day since July 1st.

- Returns: While TITAN has seen some ups and downs, the overall return over the past 26 trading sessions has been a slight decrease of 2.04%. This means an investment of ₹10,000 would be worth ₹9,796 today.

- Financial Snapshot: Over the past 12 months, TITAN generated a strong revenue of ₹51,084 Crore and a healthy profit of ₹3,495.99 Crore.

- As of July 4th, 2024, TITAN has a Market Capital of ₹3,06,218.19 Crore.

- What’s Next? TITAN is currently facing some bearish pressure. It’s wise to keep a close eye on its movement, especially considering its short-term trends. You might want to check out the TITAN Target for Tomorrow and the TITAN Targets for 2024 & 2025 for more insights.

TITAN Financial Performance

Nifty 500 Performance Overview

The Nifty 500 started the day at ₹22,937.8, showing some ups and downs throughout the session. It reached a low of ₹22,867.8 and a high of ₹22,962.15 before closing at ₹22,918.3, up 0.29% for the day.

Take a look at the table below to see the top gainers and losers that impacted the Nifty 500’s movement today.

Nifty 500 Top Gainers

Nifty 500 Top Losers

Nifty 51 to 500 Stocks To Watch for Tomorrow

➲ MphasiS (Looking Strong)

- Performance Overview: Over the past 26 trading days, MphasiS has closed higher 17 times and lower 9 times. That’s a solid performance!

- Recent Trend: MphasiS has been on an impressive 8-day winning streak, with no closing in the red since Monday, June 24, 2024.

- Returns: MphasiS delivered a strong 8.12% return over the last 26 trading sessions. This means that an investment of ₹10,000 would have grown to ₹10,812.

- Financial Insight: Over the past 12 months, MphasiS has generated a substantial revenue of ₹13,278.51 Crore and generated a profit of ₹1,554.81 Crore.

- As of Thursday, July 4, 2024, MphasiS has a Market Capital of ₹48,575.86 Crore.

- Summary: MphasiS is showing a robust and bullish pattern. Investors are keeping a close eye on its price movements for both short-term and long-term growth opportunities. Check out MphasiS Target for Tomorrow and MphasiS Targets for 2024 & 2025.

MphasiS Financial Performance

➲ Ashok Leyland (Bearish Pattern)

- Performance Overview: Ashok Leyland has had a bit of a mixed bag over the last 26 trading sessions. It closed in the red 14 times and in the green 12 times.

- Recent Trend: Things have been a little rough for Ashok Leyland lately. It’s been on a 5-day red streak, with no green days since Thursday, June 27, 2024.

- Returns: Over the past 26 trading sessions, Ashok Leyland provided a 2.1% return. This means that if you invested ₹10,000, your investment would have grown to ₹10,209.99.

- Financial Insight: In the past 12 months, Ashok Leyland generated a revenue of ₹45,790.63 Crore and made a profit of ₹2,483.51 Crore.

- As of Thursday, July 4, 2024, Ashok Leyland has a Market Capital of ₹68,870.78 Crore.

- Summary: Ashok Leyland is currently facing a bearish trend. It’s a good idea for investors to keep a close eye on its performance. You may want to check out the Ashok Leyland Target for Tomorrow and Ashok Leyland Targets for 2024 & 2025 for more insights.

Ashok Leyland Financial Performance

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores