Nifty closed at ₹24,331.05 (+0.02%), with Coal India showing bullish momentum. RVNL Jumped +15.46% & Paytm Jumped +8.34% Today

Show Table of Contents

Top Indices Performance Overview

Nifty 50 Performance Overview

The Nifty 50 kicked off the day at ₹24,321.65, showing a bit of a rollercoaster ride throughout the session. It dipped to a low of ₹24,240.55 before climbing to a high of ₹24,344.59. Ultimately, it closed the day at ₹24,331.05, a slight gain of +0.02%.

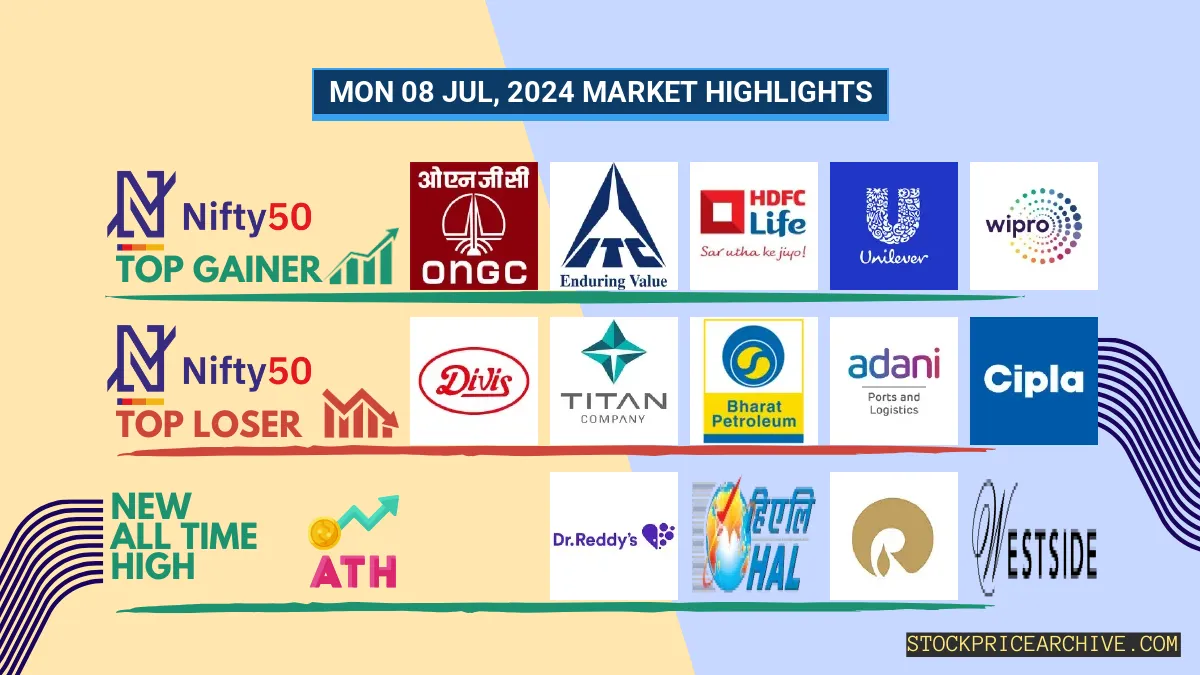

The movers and shakers behind today’s Nifty 50 performance were the top gainers and losers, which you can see listed in the table below.

Nifty 50 Top Gainers

Nifty 50 Top Losers

Nifty 50 Stocks To Watch for Tomorrow

Coal India (Bullish Pattern)

- Performance Overview: Over the past 25 trading sessions, Coal India closed higher 14 times and lower 11 times.

- Recent Trend: Coal India has been on a 7-day winning streak, without a single day closing lower since Thursday, June 27, 2024.

- Returns: Coal India delivered a -4.22% return over the last 25 trading sessions. This means an investment of ₹10,000 would have become ₹9,578.

- Financial Insight: In the past 12 months, Coal India generated revenue of ₹1,30,325.64 Crore and earned a profit of ₹37,402.28 Crore.

- As of Monday, July 8, 2024, Coal India has a Market Capital of ₹3,02,898.19 Crore.

- Summary: Coal India is showing strong signs of bullish momentum. Investors should keep a close eye on its price movements for both short-term and long-term growth potential. Check out Coal India Target for Tomorrow and Coal India Targets for 2024 & 2025.

Coal India Financial Performance

➲ TITAN (Bearish Pattern)

- Performance Overview: Over the last 25 trading sessions, TITAN’s stock has closed lower 14 times and higher 11 times.

- Recent Trend: TITAN has been on a downward trend for the past 5 days, with no closing gains since Monday, July 1, 2024.

- Returns: In the last 25 trading sessions, TITAN has yielded a -4.54% return. This means an investment of ₹10,000 would be worth ₹9,546 today.

- Financial Insight: Over the past 12 months, Coal India has generated a revenue of ₹51,084 Crore and a profit of ₹3,495.99 Crore.

- As of Monday, July 8, 2024, Coal India has a Market Capital of ₹3,06,218.19 Crore.

- Summary: TITAN is currently in a bearish phase. Keep a close eye on upcoming price movements, especially the TITAN Target for Tomorrow and TITAN Targets for 2024 & 2025.

TITAN Financial Performance

Nifty 500 Performance Overview

The Nifty 500 started the day at ₹23,029.34, showing some volatility throughout the session. It dipped to a low of ₹22,897.94 before rallying to a high of ₹23,040.75. In the end, it closed at ₹22,971.15, ending the day with a slight downward movement of -0.08%.

Let’s take a peek at the top gainers and losers that shaped the Nifty 500’s performance today.

Nifty 500 Top Gainers

Nifty 500 Top Losers

Nifty 51 to 500 Stocks To Watch for Tomorrow

Narayana Hrudayalaya: A Bullish Outlook

- Performance Overview: In the past 25 trading sessions, Narayana Hrudayalaya has shown strength, closing higher on 16 days and lower on 9.

- Recent Trend: Narayana Hrudayalaya has been on a roll! It’s been on a 10-day winning streak, closing higher every day since Monday, June 24, 2024.

- Returns: Narayana Hrudayalaya delivered a solid 2.45% return over the last 25 trading sessions. This means an investment of ₹10,000 would have grown to ₹10,245 during that time.

- Financial Insight: Over the past year, Narayana Hrudayalaya generated impressive revenue of ₹5,018.24 Crore and earned a profit of ₹789.26 Crore.

- As of Monday, July 8, 2024, Narayana Hrudayalaya boasts a Market Capital of ₹25,380.39 Crore.

- Summary: Narayana Hrudayalaya is painting a positive picture for investors. Its strong performance and bullish trend make it an interesting stock to watch. Are you looking for potential targets for short-term or long-term growth? Checkout Narayana Hrudayalaya Target for Tomorrow and Narayana Hrudayalaya Targets for 2024 & 2025.

Narayana Hrudayalaya Financial Performance

➲ Apollo Tyres (Bearish Pattern)

- Performance Overview: Over the past 25 trading days, Apollo Tyres has closed lower 14 times and higher 11 times. This suggests some volatility in its recent performance.

- Recent Trend: Apollo Tyres has been on a downward trend for the past five days, closing lower each day since Monday, July 1, 2024.

- Returns: Apollo Tyres delivered a 9.5% return over the last 25 trading sessions. This means that if you had invested ₹10,000, your investment would be worth ₹10,950 today.

- Financial Insight: Over the past 12 months, Apollo Tyres generated revenue of ₹25,377.71 Crore and earned a profit of ₹1,721.86 Crore.

- As of Monday, July 8, 2024, Apollo Tyres has a Market Capital of ₹33,301.51 Crore.

- Summary: Apollo Tyres is currently in a bearish phase. It’s important to keep a close eye on its performance. You can check out our predictions for Apollo Tyres’ Target for Tomorrow and Apollo Tyres’ Targets for 2024 & 2025.

Apollo Tyres Financial Performance

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores