Promoters Sell ₹4,200 Crore Stake; Cement Stock Gains 4% Amid The Block Deal

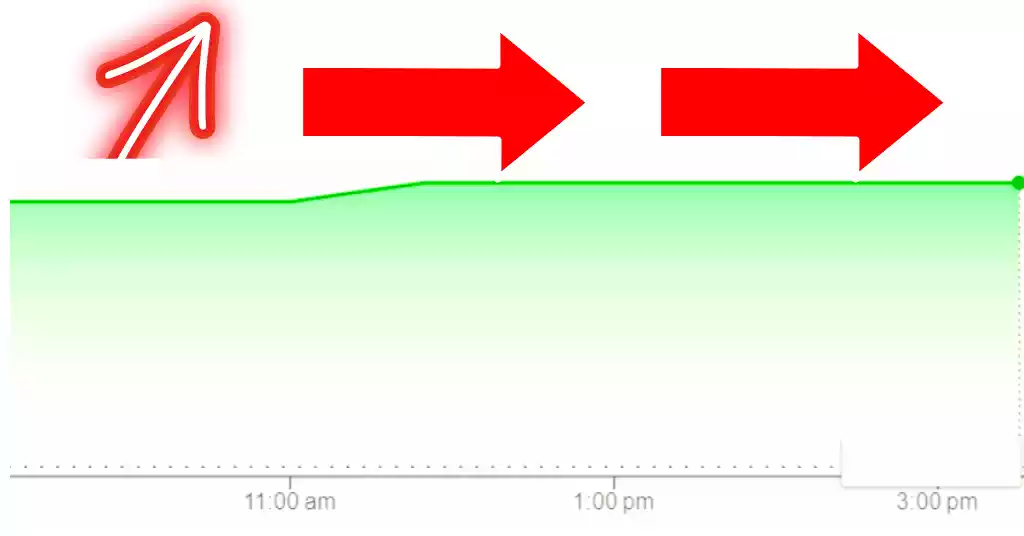

Ambuja Cements Ltd (NSE: AMBUJACEM) Block Deal: The stock of the world’s largest cement firm Ambuja Cement saw a rise on Friday. On Friday the share closed at Rs 635. The stock climbed after promoters signed a huge block deal with the company.

In the pre-open, several transactions of 6.79 Cr shares were seen in the stock. In all, 2.76 percent equity was taken care of. The promoters sold Rs 4,200 crore stake.

The promoter Group Holderind Investments has sold its 2.76 percent stake. The stock was trading at Rs 637.

It was previously said by the Promoter Adani Group would sell a three percent stake in Ambuja Cement for $500 million.

The promoters of Adani Group can sell their 3 percent stake in Ambuja Cements. It is a part of the normal adjustment that keeps this stake at the level that is desired.

The price of the offer of Rs 600 is per share. This is 5 percent less than Thursday’s closing value which was the price of Rs 632.90 according to BSE.

The promoter group, headed by the industrialist Gautam Adani holds shares of $125 billion in the 10 listed companies belonging to the group.

According to reports, he claimed that the group has made adjustments to meet the needs of investors. The company is attracting long-term investors on a massive scale.

He also said that adjustments to the stake are regularly made. The goal of this is to keep promotion stakes to a level they wish to achieve.

Ambuja Cements Ltd Stock Performance

| Current Price | ₹ 635 |

| 52-wk High | ₹ 707 |

| 52-wk Low | ₹ 404 |

| 5 Days Return | -0.07% |

| 1 Month Return | -8.15% |

Key Fundamentals Parameters

| Market Cap | ₹ 1,56,408 Cr. |

| Stock P/E | 49.1 |

| Book Value | ₹ 176 |

| Dividend | 0.31 % |

| ROCE | 14.0 % |

| ROE | 10.3 % |

| Face Value | ₹ 2.00 |

| P/B Value | 3.62 |

| OPM | 18.4 % |

| EPS | ₹ 15.6 |

| Debt | ₹ 699 Cr. |

| Debt to Equity | 0.02 |

Ambuja Cements Ltd Share: Last 5 Years’ Financial Condition

Last 5 Years’ Sales:

| 2019 | ₹ 27,104 Cr |

| 2020 | ₹ 24,516 Cr |

| 2021 | ₹ 28,965 Cr |

| 2023 | ₹ 38,937 Cr |

| 2024 | ₹ 32,758 Cr |

Last 5 Years’ Net Profit:

| 2019 | ₹ 2,783 Cr |

| 2020 | ₹ 3,107 Cr |

| 2021 | ₹ 3,711 Cr |

| 2023 | ₹ 3,024 Cr |

| 2024 | ₹ 4,392 Cr |

Disclaimer: The information on this site is only for informational and educational purposes and shouldn’t be considered financial advice or stock recommendations.