REC Share Price Target (2024, 2025, 2026, 2027, 2030, 2050)

REC Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030) | REC Limited Fundamentals, Financial Trends, Businesses and more.

Are you just want to invest in REC shares but little bit confused what its future predictions according to some experts it will grow or not and what will be the best year for the REC share price target to achieve all are going to answer in this post.

I researched a lot across various articles, news, books, and the whole internet to summarize and make a brief in-depth research for you all related to REC Limited.

Now it’s time to dive in and start our article by knowing what is REC Limited.

What Is Rec Limited?

REC Limited, also known as Rural Electrification Corporation Limited, is a public sector enterprise in India that specializes in financing and promoting rural electrification projects.

| Rec Limited | Information |

|---|---|

| Parent Organisation | Rec Limited |

| Founded In | 1969 |

| Founder | Shri Vivek Dewangan |

| Market Cap | 32,467 Cr Rs |

| Profit | 10,306 Cr Rs |

The company was established on July 25, 1969, under the Companies Act, 1956, as a wholly-owned subsidiary of the Government of India’s Ministry of Power. REC Limited is headquartered in New Delhi, India.

Back Story Of REC Limited

In a country where access to electricity was a luxury for many rural households, a visionary idea was born.

To bring light to the lives of millions, Rural Electrification Corporation Limited (REC Limited) was established on July 25, 1969, under the Companies Act, 1956, as a wholly-owned subsidiary of the Government of India’s Ministry of Power.

The backstory of REC Limited is rooted in the pressing need for rural electrification in India during the 1960s.

The lack of electricity in rural areas posed a significant challenge to the socio-economic development of these communities.

Recognizing this, the Government of India took a bold step and established REC Limited as a specialized institution to provide financial assistance for rural electrification projects.

The backstory of REC Limited is rooted in the pressing need for rural electrification in India during the 1960s.

The lack of electricity in rural areas posed a significant challenge to the socio-economic development of these communities.

Recognizing this, the Government of India took a bold step and established REC Limited as a specialized institution to provide financial assistance for rural electrification projects.

The journey of REC Limited began with a vision to empower rural India by making electricity accessible to every household.

The company’s main purpose was to provide financial help to state electricity boards, state governments, and others involved in electricity-related projects in rural and semi-urban areas.

REC Limited’s mission was to fulfill the demand and supply of electricity in rural areas and also promote inclusive growth by improving the quality of life for rural communities.

Over the years, REC Limited has achieved several milestones.

The company has been recognized now for its contribution to rural electricity and has received numerous awards for its work.

REC Limited’s impact on rural communities can be seen as we can see the growth of education, healthcare, and livelihood opportunities, leading to good life.

REC Financial Trends

The financial trends of REC Limited are increasing in ascending order and also it will increase in the future as we can see that in the year 2021 8,378 Cr and in the year 2022 it will be 10,036 Cr.

Also, the profits are in ascending order and as we know if the company is both in good position it is a good sign for the future price.

| Year | Minimum Price In RS | Maximum Price In RS |

|---|---|---|

| REC Share Price Target 2024 | 450 | 523 |

| REC Share Price Target 2025 | 524 | 570 |

| REC Share Price Target 2026 | 571 | 598 |

| REC Share Price Target 2027 | 600 | 629 |

| REC Share Price Target 2028 | 630 | 668 |

| REC Share Price Target 2029 | 670 | 695 |

| REC Share Price Target 2030 | 681 | 707 |

| REC Share Price Target 2050 | 1300 | 1400 |

In the last 6 months, the company showed good growth for its stockholders as it has given 10% ROI which is a happy moment for every investor.

| 2024 | Lower Targets | Higher Targets |

|---|---|---|

| January | ₹444 | ₹450 |

| February | ₹461 | ₹492 |

| March | ₹464 | ₹496 |

| April | ₹466 | ₹496 |

| May | ₹469 | ₹500 |

| June | ₹474 | ₹504 |

| July | ₹479 | ₹510 |

| August | ₹481 | ₹512 |

| September | ₹483 | ₹514 |

| October | ₹492 | ₹524 |

| November | ₹496 | ₹528 |

| December | ₹504 | ₹523 |

After seeing the company’s growth many new investors invested in this stock. Today time when I am writing this stock I can see the price is about 450 Rs and it can become 523 Rs this year so if you are searching for REC Share Price Target 2024 then at maximum it will be 523 Rs.

As per the report of the company’s financial market cap of 32,467 Crore Rs, we can conclude the company showed us good growth and can handle the loss if happens in the future. So the company’s debt will be less so it will always be maximum in profit.

| 2025 | Lower Targets | Higher Targets |

|---|---|---|

| January | ₹488 | ₹524 |

| February | ₹491 | ₹527 |

| March | ₹493 | ₹527 |

| April | ₹498 | ₹529 |

| May | ₹500 | ₹531 |

| June | ₹505 | ₹538 |

| July | ₹508 | ₹539 |

| August | ₹510 | ₹541 |

| September | ₹515 | ₹550 |

| October | ₹522 | ₹553 |

| November | ₹528 | ₹563 |

| December | ₹534 | ₹570 |

So the REC Share Price Target 2024 will also be high and according to some experts, it will be 524 Rs at minimum and 570 Rs at maximum.

REC’s share price Target for 2030 is going to be high and will cross all the expectations as it will give you more than you expect. The minimum price it will touch is 644 Rs and 707 Rs.

| 2030 | Lower Targets | Higher Targets |

|---|---|---|

| March | ₹644 | ₹684 |

| June | ₹653 | ₹691 |

| September | ₹661 | ₹699 |

| December | ₹669 | ₹707 |

Now why the difference will cross that high because it the company has crossed its profit more and got ₹ 10,045.92 Cr in RS in 2022.

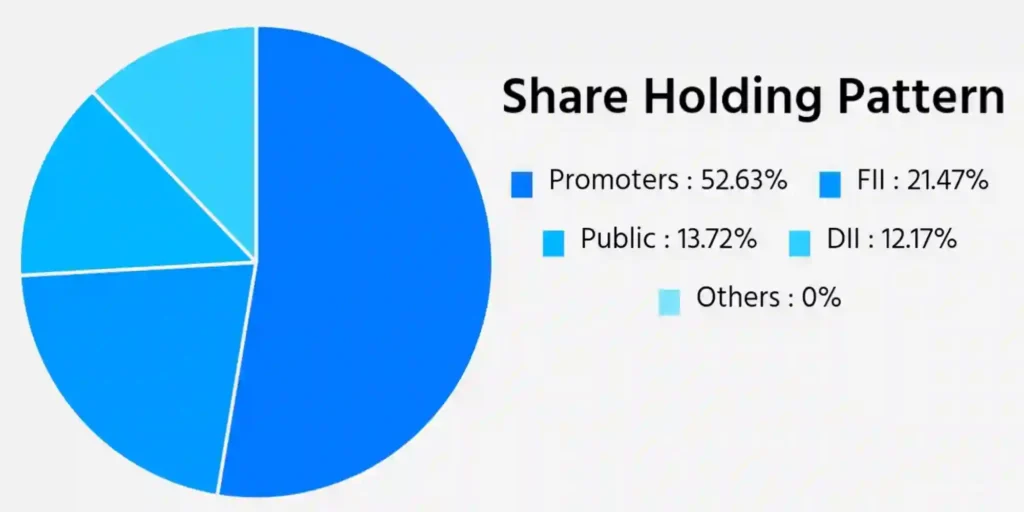

According to the shareholding the promoters holding is 52.63% and it is huge as it increases the companies fundamentals.

In 2050 according to us, the price can cross from 1300 Rs to 1400 Rs it can vary but yes it will be in this range only.

FAQ You May Ask Us

The prediction of the share price of REC Limited is 240RS minimum and 278RS maximum.

The prediction of the share price of REC Limited is 420RS minimum and 429.1RS maximum.

Is REC Limited a debt-free company?

No, at present REC Limited has a debt of ₹ 358,930 crore.

Conclusion

It is here finally we tried hard to predict the REC Share Price Target (2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030) according to all the reports we got.

Also, we will give you a suggestion before investing try research as much as possible as we can also be wrong at some times to predict the right price.

Also read:

Also, comment to us Are you investing in this stock and if yes how many stocks you are going to buy today?