Suzlon Energy Share Price Target (2024, 2025, 2030, 2050)

Today in this post of Target price we are going to predict the best renewable energy company Suzlon Energy Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, 2030, and 2050.

Also, it is based on the information available on the internet and also some of my experiences.

Now, as you know day by day renewable energy sources are coming front for the applicants as they reduce various hazards.

Today We will analyze the following points given in the table of contents you can follow it to read the article.

Now let’s start the article without further due.

Company Overview

Suzlon is one of the best renewable energy companies in our country which is a multinational wind turbine manufacturer and renewable energy provider.

Also it world’s leading wind turbine manufacturer with having capacity of 19 GW of cumulative installed capacity.

It’s headquarters is situated in Pune, India and also it has taken over its business to over 17+ countries which is huge for a company.

| Aspect | Information |

|---|---|

| Company Name | Suzlon Energy Limited |

| Founded | 1995 |

| Headquarters | Pune, India |

| Industry | Wind Energy |

| Key Products | Wind Turbines |

| Revenue | ₹59Billion (5,900Cr) |

| Net income | ₹100.9 Crore (100.9Cr) |

| Diluted EPS | 0.08 |

| Net profit margin | 7.49% |

| Website | www.suzlon.com |

Company Model

Suzlon Industries also offers a variety of design, manufacture, installation, and maintenance of wind turbines.

Also, they offer other renewable energy such as solar power and energy storage.

Fundamentals

Suzlon Energy has a strong track record of growth. The company’s revenue has grown at a CAGR of over 20% in the past five years.

| Company Essentials | Value |

|---|---|

| MARKET CAP | ₹ 43,696.73 Cr. |

| ENTERPRISE VALUE | ₹ 45,738.10 Cr. |

| NO. OF SHARES | 1,361.27 Cr. |

| P/E | 0 |

| P/B | 12.63 |

| FACE VALUE | ₹ 2 |

| DIV. YIELD | 0 % |

| BOOK VALUE (TTM) | ₹ 2.54 |

| CASH | ₹ 290.63 Cr. |

| DEBT | ₹ 2,332 Cr. |

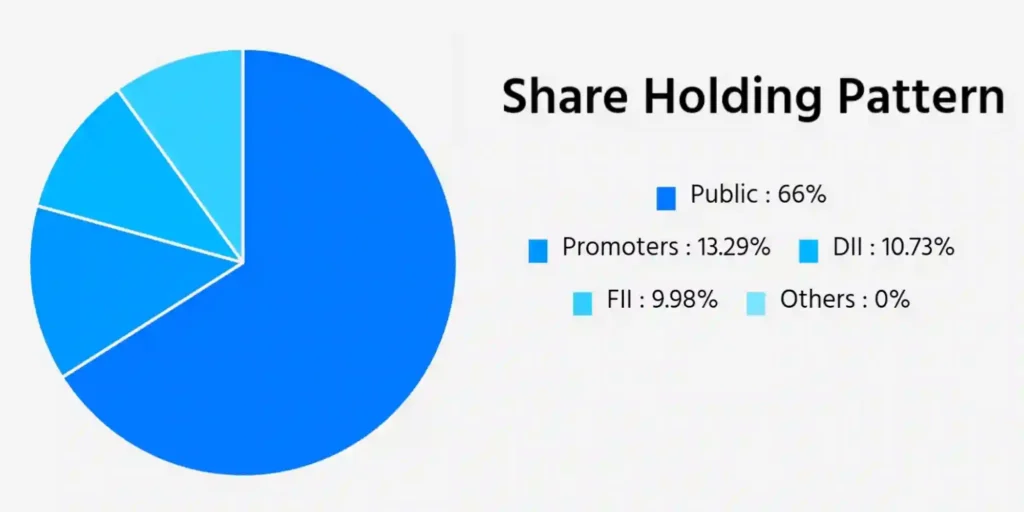

| PROMOTER HOLDING | 13.29 % |

| EPS (TTM) | ₹ 0.11 |

| SALES GROWTH | 11.13% |

| ROE | 0 % |

| ROCE | 126.41% |

| PROFIT GROWTH | 336.97 % |

Suzlon is also having a net profit margin of over 10%.

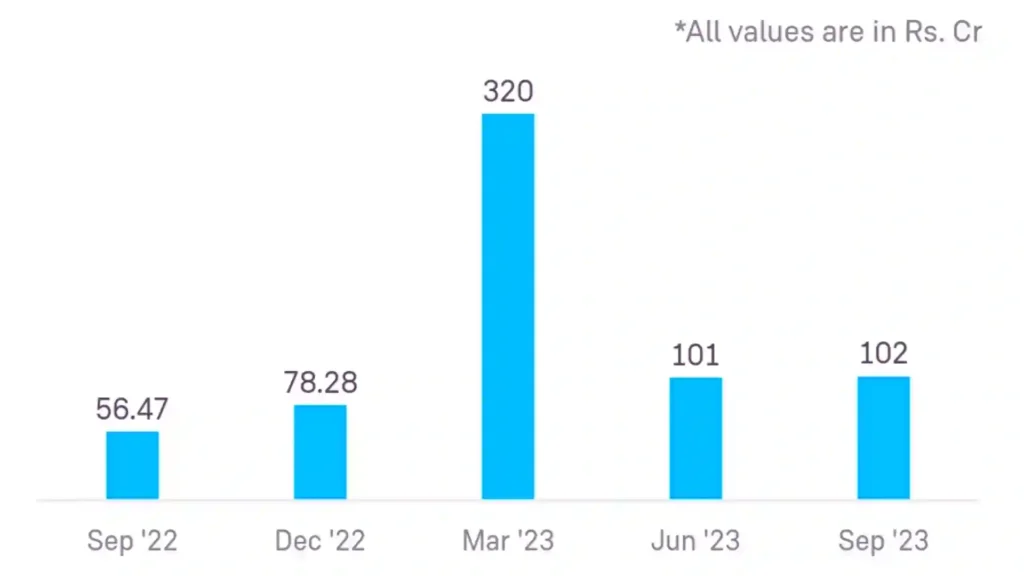

Financials

| Financial Year | Mar-2023 | Mar-2022 | Mar-2021 | Mar-2020 | Mar-2019 |

|---|---|---|---|---|---|

| Sales | 5,971 | 6,582 | 3,346 | 2,973 | 5,025 |

| Expenses | 5,139 | 5,692 | 2,811 | 3,833 | 5,033 |

| Operating Profit | 832 | 889 | 534 | -860 | -9 |

| OPM % | 14% | 14% | 16% | -29% | -0% |

| Other Income | 20 | 22 | 20 | 28 | 50 |

| Interest | 421 | 735 | 996 | 1,367 | 1,270 |

| Depreciation | 260 | 260 | 258 | 419 | 342 |

| Profit Before Tax | 2,892 | 0 | 105 | -2,684 | -1,543 |

| Tax % | 0% | 41,647% | 4% | -0% | 1% |

| Net Profit | 2,887 | -166 | 100 | -2,691 | -1,531 |

| EPS | 3 | -0 | 0 | -5 | -3 |

| Summary | Jun 2023 | Mar 2023 |

|---|---|---|

| Promoter | 14.5% | 14.5% |

| FII | 7.8% | 7.6% |

| DII | 5.9% | 5.6% |

| Public | 71.8% | 72.3% |

| Others | 0.0% | 0.0% |

Pros & Cons

Pros

- Consistently strong stock performance.

- Steady annual growth in earnings per share (EPS).

- Smart use of shareholders’ funds, showing better Return on Equity (ROE) over the past two years.

Weaknesses

- Mutual funds reduced their ownership recently.

- Drop in both revenue and profit, highlighting business challenges.

- Cash flow is on a downward trend, indicating difficulty in generating positive cash.

Competitors

There are many competitors in this industry as a result Suzlon has a good amount of Competitors now in this field such as Vestas, Siemens Gamesa, and GE Renewable Energy.

There is only an up graph for Suzlon Energy’s Share Price as its price is increasing it’s not in a mood to decrease because of company’s fundamentals and performance are good.

From the price of 5₹ to 32₹ in 2023 I think so it will increase soon more in upcoming years too.

Analysis Rating

| Category | Rating |

|---|---|

| Ownership |

★ |

| Valuation | – |

| Efficiency |

★ |

| Financials | ★ ★ ★ ★ |

Below is the table of Suzlon Share Price Target from 2024 to 2050.

| Year | Share Price Target |

|---|---|

| 2024 | ₹50.90 |

| 2025 | ₹59.52 |

| 2026 | ₹69.36 |

| 2027 | ₹79.77 |

| 2028 | ₹93.53 |

| 2029 | ₹101.49 |

| 2030 | ₹120.58 |

| 2050 | ₹500 |

Day by day government of India is giving a push to energy made from renewable sources hence its stock price may rise more in the future and also it can have 41.2₹ – 50.9₹ max.

| Minimum Target: | 41.2₹ |

| Maximum Target: | 50.9₹ |

That means Suzlon Share Price Target 2024 will be 47₹ at the end of December.

| Minimum Target: | 50₹ |

| Maximum Target: | 60₹ |

Suzlon Energy is India’s leading wind turbine manufacturer and has a strong market share in both the domestic and international markets.

Analysts expect its share price to reach Rs 60₹ by September 2025.

| Minimum Target: | 60₹ |

| Maximum Target: | 69.36₹ |

In the future, Suzlon is going to lead the market hence we predicted Suzlon Energy’s Share Price Target 2026 to be 60₹ to 69.36₹.

As of 2026, many possibilities for the government to strictly make use of renewable sources for all its manufacturers.

| Minimum Target: | 69.9₹ |

| Maximum Target: | 79.77₹ |

Analysts expect Suzlon Energy’s Share Price Target in 2027 to reach ₹69.9 – ₹79.77. Due to financial good in status.

We expect Suzlon Energy’s Share Price Target 2028 to reach ₹90-₹120. Due to financial good in status.

| Minimum Target: | 90Rs |

| Maximum Target: | 120Rs |

Now as per our knowledge, we expect Suzlon Energy Share Price Target 2030 to reach 120₹-300₹. Due to financial good in status.

| Minimum Target: | 120₹ |

| Maximum Target: | 300₹ |

We expect Suzlon Energy Share Price Target 2050 to reach ₹500-600₹. Due to financially good status.

| Minimum Target: | 500₹ |

| Maximum Target: | 600₹ |

FAQ You May Ask Us

Is Suzlon a good buy for 2024?

Yes, it is good to buy Suzlon as it will only increase till 2050 as per our knowledge as the government is focusing nowadays on renewable energy.

Is Suzlon a good buy for the long term?

Definitely Yes, Why because renewable energy is going to boom in India soon.

What is the target price of Suzlon in 2030?

According to our predictions, it can be from 120₹ to 300₹ in 2030.

What is the target of Suzlon Energy in 2024?

Now Suzlon share price increase 400% in 6 months in November 2023. So definitely it is going to boom the market in 2024 too.

Conclusion

So finally we predicted Suzlon’s Energy Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, 2030, and 2050 now it’s your turn to decide whether to buy or not.

I would like to conclude that this stock is a green signal to buy.

If you hold it till 2025 it will be a good stock and a best decision for you.

Also read:

Also, comment us which stock in your portfolio is going to perform best in 2024.