Biggest Auto Company Announced 4000 Crore Share Buyback; 29th February Fixed

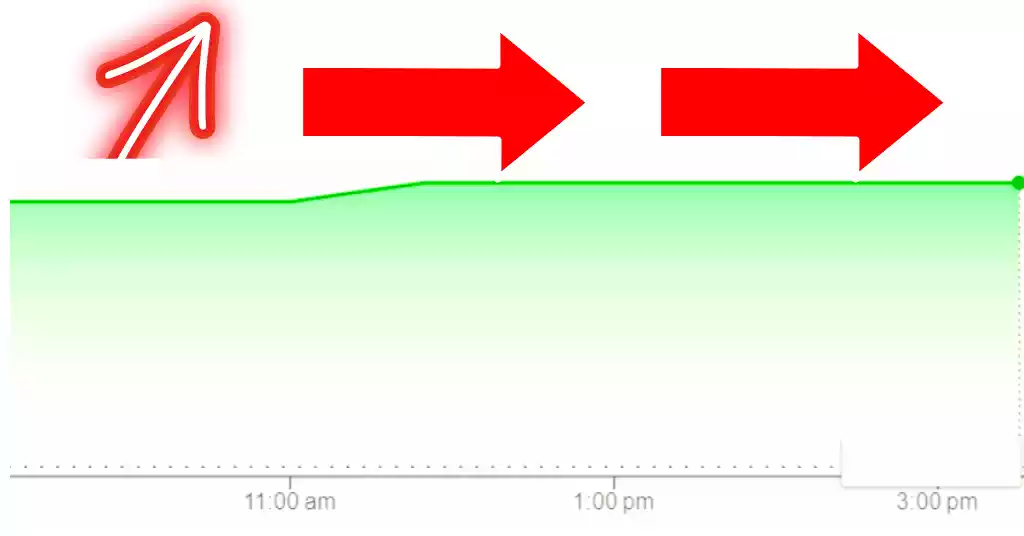

The country’s biggest auto company Bajaj Auto (NSE: BAJAJ-AUTO) is going to do a share buyback. The decision on this was taken in the board meeting held on January 8.

But now in the information given to the exchange, the company has fixed the record date. The date of the record has been set as 29th Feb.

According to the company, Bajaj Auto will spend Rs 4000 crore on share buyback. This share purchase will be through the tender route.

According to the information given in the exchange, a buyback of up to 40 lakh shares has been approved.

The company is buying back shares at Rs 10,000 per share. On Friday, the company’s shares increased by 2.72 percent and closed at Rs 8344.

What is Share buyback?

Share buybacks occur when a company uses its own capital to purchase its shares. The equity of a company is reduced when a share buyback occurs.

The shares purchased from the market will be cancelled. Shares bought back from the market cannot be issued again.

Due to the reduction in equity capital, the company’s share earnings i.e. EPS increases. Stock buybacks improve the P/E ratio.

About Bajaj Auto Ltd

BAJAJ Auto Limited is a top manufacturer of motorcycles and tri-wheelers across India. It was established in 1945 as an automobile sales firm.

Today, it is the third-largest producer of motorcycles and the largest manufacturer of three-wheelers worldwide. It is India’s biggest exporter of three-wheelers, motorcycles, and quadricycles.

It is the flagship company part of the Bajaj Group and was incorporated under the Companies Act, of 1956 and has a registered office in Mumbai.

In the period 2022-23, the Company achieved record-breaking sales of five million vehicles. It also recorded the highest turnover ever recorded at the sum of Rs 37,609 crores.

The company also raked in an overall profit after tax of 6,060 crores. Bajaj Company is acknowledged across Latin America, Africa, the Middle East, and South and South East Asia.

Fundamental Analysis of Bajaj Auto Ltd

| Market Cap | ₹ 2,35,749 Cr. |

| Current Price | ₹ 8,344 |

| 52-wk High | ₹ 8,455 |

| 52-wk Low | ₹ 3,625 |

| Stock P/E | 31.8 |

| Book Value | ₹ 1,036 |

| Dividend | 1.68 % |

| ROCE | 26.2 % |

| ROE | 20.2 % |

| Face Value | ₹ 10.0 |

| P/B Value | 8.04 |

| OPM | 19.3 % |

| EPS | ₹ 262 |

| Debt | ₹ 125 Cr. |

| Debt to Equity | 0.00 |

Bajaj Auto Share Price Target 2024 To 2030

| Year | 1st Target | 2nd Target |

| 2024 | ₹8500 | ₹8765 |

| 2025 | ₹8900 | ₹9212 |

| 2026 | ₹9342 | ₹9565 |

| 2027 | ₹9765 | ₹10000 |

| 2028 | ₹10324 | ₹10643 |

| 2029 | ₹10975 | ₹11083 |

| 2030 | ₹11546 | ₹11876 |

Bajaj Auto Ltd Shareholding Pattern

| Promoters Holding | |

| Dec 2022 | 54.99% |

| Mar 2023 | 54.99% |

| June 2023 | 54.99% |

| Sept 2023 | 54.99% |

| Dec 2023 | 54.95% |

| FII Holding | |

| Dec 2022 | 11.82% |

| Mar 2023 | 12.35% |

| June 2023 | 13.67% |

| Sept 2023 | 14.37% |

| Dec 2023 | 14.64% |

| DII Holding | |

| Dec 2022 | 10.91% |

| Mar 2023 | 10.79% |

| June 2023 | 9.56% |

| Sept 2023 | 9.03% |

| Dec 2023 | 8.66% |

| Govt. Holding | |

| Dec 2022 | 0.07% |

| Mar 2023 | 0.07% |

| June 2023 | 0.07% |

| Sept 2023 | 0.07% |

| Dec 2023 | 0.07% |

| Public Holding | |

| Dec 2022 | 22.20% |

| Mar 2023 | 21.79% |

| June 2023 | 21.72% |

| Sept 2023 | 21.54% |

| Dec 2023 | 21.67% |

Bajaj Auto Ltd Share: Last 5 Years’ Financial Condition

To gain a better understanding of how the market is performing, let’s look at the outlook of this share in the previous years.

However, investors should be aware of the risks and the market conditions before making any investment decision.

Last 5 Years’ Sales:

| 2019 | ₹ 30,358 Cr |

| 2020 | ₹ 29,919 Cr |

| 2021 | ₹ 27,741 Cr |

| 2022 | ₹ 33,145 Cr |

| 2023 | ₹ 42,245 Cr |

Last 5 Years’ Net Profit:

| 2019 | ₹ 4,928 Cr |

| 2020 | ₹ 5,212 Cr |

| 2021 | ₹ 4,857 Cr |

| 2022 | ₹ 6,166 Cr |

| 2023 | ₹7,402 Cr |

Last 5 Years’ Debt-To-Equity Ratio:

| 2019 | 0 |

| 2020 | 0 |

| 2021 | 0 |

| 2022 | 0 |

| 2023 | 0 |

Last 10 Years’ Profit Growth:

| 10 Years: | 7% |

| 5 Years: | 7% |

| 3 Years: | 5% |

| Current Year: | 31% |

Last 10 years’ Return on Equity (ROE):

| 10 Years: | 23% |

| 5 Years: | 21% |

| 3 Years: | 20% |

| Last Year: | 20% |

Sales Growth Over 10 Years:

| 10 Years: | 6% |

| 5 Years: | 8% |

| 3 Years: | 7% |

| Current Year: | 19% |

Conclusion

This article is a complete guide about Bajaj Auto Ltd Share.

These information and forecasts are based on our analysis, research, company fundamentals and history, experiences, and various technical analyses.

Also, We have talked in detail about the share’s future prospects and growth potential.

Hopefully, these informations will help you in your further investment.

If you are new to our website and want to get all the latest updates related to the stock market, join us on Telegram Group.

If you have any further queries, please comment below. We will be happy to answer all your questions.

If you like this information, share the article with as many people as possible.

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information on this site is only for informational and educational purposes and shouldn’t be considered financial advice or stock recommendations. Also, the share price predictions are completely for reference purposes. The price predictions will only be valid when there are positive signs on the market. Any uncertainty about the company’s future or the current state of the market will not be considered in this study. We are not responsible for any financial loss you might incur through the information on this site. We are here to provide timely updates about the stock market and financial products to help you make better investment choices. Do your own research before any investment.