Near 15% Return In A Single Day; 440 Crore Flats Sold; Last Year 127% Return

Today, in this post we’ll discuss about Ashiana Housing latest news, fundamentals, potential growth areas, and all sorts of information regarding this company to gain a better understanding. We hope our analysis will provide you better insight about the company.

There’s been a significant rise in the price of shares of real estate company Ashiana Housing(NSE: ASHIANA).

The company’s shares rose by more than 15 percent on Monday to reach Rs 386.65.

Shares of Ashiana Housing also made a new 52-week high on Monday and the shares of the company reached Rs 396.40.

Ashiana Housing has reported that the company sold 224 luxury apartments in Gurugram for a total of Rs 44 crore in just 15 minutes of its launch.

This project of the company is in Sector 93 of Gurugram.

All The Flats Were Sold Within 15 Minutes

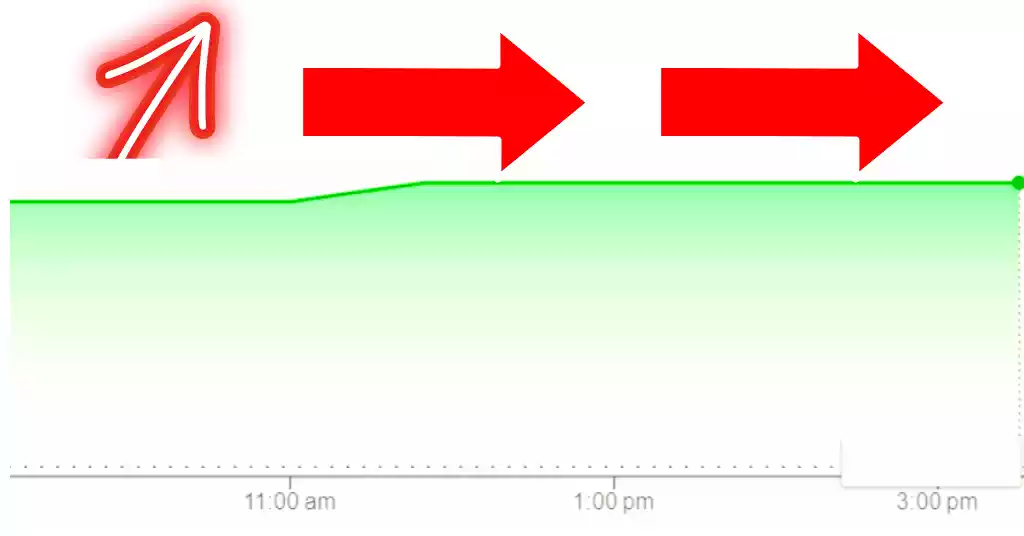

Ashiana Housing has announced that it completed the entire third phase of its famous project Ashiana Amarah in just fifteen minutes.

Joint Managing Director of Ashiana Housing, said, “We are thrilled with the overwhelming response we received for this launch. Ashiana Amarah Phase 3. Registration started around 11 a.m. and by 11.15 it was reported that there had been 800 people who checked in that accounted for an additional 224 units. Within 15 minutes this project was oversubscribed 4 times.”

Company’s Shares Rose 127% In One Year

Shares of Ashiana Housing have risen 127% in the last year. The company’s shares stood at 170.55 on the 17th of April 2023.

Shares of Ashiana Housing closed at Rs 386.65 on 15 April 2024.

At the same time, shares of Ashiana Housing have increased by 67% in the last 6 months. In the course of this time, its shares have risen from Rs 232 to 386.

In the last 4 years, there has been a tremendous rise of 721% in the shares of Ashiana Housing.

The shares of the real estate company were at Rs 47.10 on April 17, 2020, which have now reached Rs 386.65.

The 52-week high level of Ashiana Housing shares is Rs 396.40. In the same, way the 52-week low for shares of the firm will be 163.05.

About Ashiana Housing Company

Ashiana Housing Limited is an Indian company. The primary business area of the company includes Real Estate Development.

The Company operates across the States including Rajasthan, Maharashtra, Jharkhand, Haryana, West Bengal, Tamil Nadu & Gujarat.

The most sought-after homes by the Company comprise Vrinda Garden, Ashiana Tarang, Ashiana Amantran, Ashiana Sehar, Ashiana Prakriti, Ashiana Ekansh, Ashiana Dwarka, and Ashiana Malhar.

The Senior Living projects of the Company comprise Ashiana Nirmay Ashiana Advik Ashiana Shubham Ashiana Utsav & Ashiana Amodh.

The Company’s kid-friendly housing projects are Amarah By Ashiana, Ashiana Town, Ashiana Umang, and Ashiana Anmol.

The company’s subsidiaries comprise Topwell Projects Consultants Ltd, Ashiana Maintenance Services LLP, Latest Developers Advisory Ltd, and Ashiana Amar Developers.

Fundamental Analysis of Ashiana Housing

| Market Cap | ₹ 3,891 Cr. |

| Current Price | ₹ 387 |

| 52-wk High | ₹ 399 |

| 52-wk Low | ₹ 163 |

| Stock P/E | 50.9 |

| Book Value | ₹ 74.9 |

| Dividend | 0.13% |

| ROCE | 3.92 % |

| ROE | 3.62 % |

| Face Value | ₹ 2.00 |

| P/B Value | 5.17 |

| OPM | 10.7% |

| EPS | ₹ 7.56 |

| Debt | ₹ 133 Cr. |

| Debt to Equity | 0.18 |

Ashiana Housing Share Price Target 2024 To 2030

| Year | 1st Target | 2nd Target |

| 2024 | ₹350 | ₹400 |

| 2025 | ₹412 | ₹488 |

| 2026 | ₹468 | ₹540 |

| 2027 | ₹529 | ₹584 |

| 2028 | ₹600 | ₹628 |

| 2029 | ₹700 | ₹748 |

| 2030 | ₹750 | ₹777 |

Ashiana Housing Shareholding Pattern

| Promoters Holding | |

| Mar 2023 | 61.22% |

| June 2023 | 61.22% |

| Sept 2023 | 61.11% |

| Dec 2023 | 61.11% |

| Mar 2023 | 61.11% |

| FII Holding | |

| Mar 2023 | 7.58% |

| June 2023 | 7.67% |

| Sept 2023 | 7.86% |

| Dec 2023 | 8.24% |

| Mar 2024 | 8.28% |

| DII Holding | |

| Mar 2023 | 8.63% |

| June 2023 | 7.68% |

| Sept 2023 | 7.40% |

| Dec 2023 | 7.33% |

| Mar 2024 | 7.08% |

| Public Holding | |

| Mar 2023 | 22.57% |

| June 2023 | 23.42% |

| Sept 2023 | 23.64% |

| Dec 2023 | 23.32% |

| Mar 2024 | 23.54% |

Ashiana Housing Share: Last 5 Years’ Financial Condition

To gain a better understanding of how the market is performing, let’s look at the outlook of this share in the previous years.

However, investors should be aware of the risks and the market conditions before making any investment decision.

Last 5 Years’ Sales:

| 2019 | ₹338 Cr |

| 2020 | ₹304 Cr |

| 2021 | ₹242 Cr |

| 2022 | ₹222 Cr |

| 2023 | ₹762 Cr |

Last 5 Years’ Net Profit:

| 2019 | ₹14 Cr |

| 2020 | ₹-30 Cr |

| 2021 | ₹ 2 Cr |

| 2022 | ₹-7 Cr |

| 2023 | ₹76 Cr |

Last 5 Years’ Debt-To-Equity Ratio:

| 2019 | 0.19 |

| 2020 | 0.14 |

| 2021 | 0-07 |

| 2022 | 0.22 |

| 2023 | 0.24 |

Last 10 Years’ Profit Growth:

| 10 Years: | -1% |

| 5 Years: | -5% |

| 3 Years: | 54% |

| Current Year: | 221% |

Last 10 years’ Return on Equity (ROE):

| 10 Years: | 4% |

| 5 Years: | 0% |

| 3 Years: | 1% |

| Last Year: | 4% |

Sales Growth Over 10 Years:

| 10 Years: | 11% |

| 5 Years: | 5% |

| 3 Years: | 10% |

| Current Year: | 105% |

Conclusion

This article is a complete guide about Ashiana Housing Share.

These information and forecasts are based on our analysis, research, company fundamentals and history, experiences, and various technical analyses.

Also, We have talked in detail about the share’s future prospects and growth potential.

Hopefully, these informations will help you in your further investment.

If you are new to our website and want to get all the latest updates related to the stock market, join us on Telegram Group.

If you have any further queries, please comment below. We will be happy to answer all your questions.

If you like this information, share the article with as many people as possible.

Disclaimer: The information on this site is only for informational and educational purposes and shouldn’t be considered financial advice or stock recommendations. We are here to provide timely updates about the stock market and financial products to help you make better investment choices.